Authors:

In part 1: we will (i) automatically find the Option (of choice) closest to At The Money (ATM) and (ii) calculate its Implied Volatility & Greeks. We focus below on Future (Monthly) Options on the Index '.STOXX50E' (EURO STOXX 50 EUR PRICE INDEX) ('EUREX') and '.SPX' (S&P 500 INDEX), although you can apply the logic below for another index. To find the ATM instrument, we simply and efficiently use the Search API. Usually, the calculation of the Black-Scholes-Merton model's Implied Volatility involves numerical techniques, since it is not a closed equation (unless restricting assumptions that log returns follow a standard normal distribution with mean is zero, $\mu$ = 0, and standard deviation is zero, $\sigma$ = 1, are made). If we used these techniques in calculating each Implied Volatility value on our computer, it would take several seconds - if not minutes - for each data point computed. I have chosen to use the Instrument Pricing Analytics (IPA) service in the Python Refinitiv Data Library instead, as this service allows me to send model specifications (and variables) and receive several (up to 100) computed Implied Volatility values in one go - in a few seconds. Not only does this save a great deal of time, but also many lines of code! Fianlly, we will put it all in one function.

In part 2: We will implement a functionality allowing us to apply all we did in Part 1 to expired options. You'll see, it's not as simple as it seems. We will then put it all in one function using Type Hints. This, in itself, will also be rather new and exciting!

Content

import refinitiv.data as rd # This is LSEG's Data and Analytics' API wrapper, called the Refinitiv Data Library for Python. You can update this library with the comand `!pip install refinitiv-data --upgrade`

from refinitiv.data.content import historical_pricing # We will use this Python Class in `rd` to show the Implied Volatility data already available before our work.

from refinitiv.data.content import search # We will use this Python Class in `rd` to fid the instrument we are after, closest to At The Money.

import refinitiv.data.content.ipa.financial_contracts as rdf # We're going to need this to use the content layer of the RD library and the calculators of greeks and Impl Volat in Instrument Pricing Analytics (IPA) and Exchange Traded Instruments (ETI)

from refinitiv.data.content.ipa.financial_contracts import option # We're going to need this to use the content layer of the RD library and the calculators of greeks and Impl Volat in IPA & ETI

import numpy as np # We need `numpy` for mathematical and array manipilations.

import pandas as pd # We need `pandas` for datafame and array manipilations.

import calendar # We use `calendar` to identify holidays and maturity dates of intruments of interest.

import pytz # We use `pytz` to manipulate time values aiding `calendar` library. to import its types, you might need to run `!python3 -m pip install types-pytz`

import pandas_market_calendars as mcal # Used to identify holidays. See `https://github.com/rsheftel/pandas_market_calendars/blob/master/examples/usage.ipynb` for info on this market calendar library

from datetime import datetime, timedelta, timezone # We use these to manipulate time values

from dateutil.relativedelta import relativedelta # We use `relativedelta` to manipulate time values aiding `calendar` library.

import requests # We'll need this to send requests to servers vie a the delivery layer - more on that below

# `plotly` is a library used to render interactive graphs:

import plotly.graph_objects as go

import plotly.express as px # This is just to see the implied vol graph when that field is available

import matplotlib.pyplot as plt # We use `matplotlib` to just in case users do not have an environment suited to `plotly`.

from IPython.display import clear_output, display # We use `clear_output` for users who wish to loop graph production on a regular basis. We'll use this to `display` data (e.g.: pandas data-frames).

from plotly import subplots

import plotly

Now let's open our session with RD. You can find more information about sessions on EX-4.01.01-Sessions.ipynb.

try:

rd.open_session(

name="desktop.workspace",

config_name="C:/Example.DataLibrary.Python-main/Configuration/refinitiv-data.config.json")

except:

rd.open_session()

# For more info on the session, use `rd.get_config().as_dict()`

test_df = rd.get_data(

universe=['DSMF4'],

fields=["PROV_SYMB"],

# interval="tick"

)

test_df

| Instrument | PROV_SYMB | |

|---|---|---|

| 0 | DSMF4 |

rd.get_data(universe=["VOD.L"], fields=["TR.RIC"]) # EMAH8^A

| Instrument | RIC | |

|---|---|---|

| 0 | VOD.L | VOD.L |

for i, j in zip(

['refinitiv.data', 'numpy', 'pandas', 'pandas_market_calendars' 'pytz', 'requests', 'plotly'],

[rd, np, pd, mcal, pytz, requests, plotly]):

print(f"{i} used in this code is version {j.__version__}")

refinitiv.data used in this code is version 1.3.0

numpy used in this code is version 1.23.1

pandas used in this code is version 1.3.5

pandas_market_calendarspytz used in this code is version 4.1.4

requests used in this code is version 2022.1

plotly used in this code is version 2.28.1

FYI (For Your Information), this is out Python version:

!python -V

Python 3.10.5

EUREX Call Options¶

In this article, we will attempt to calculate the Implied Volatility (IV) for Future Options on 2 indexes (.STOXX50E & .SPX) trading 'ATM', meaning that the contract's strike price is at (or near - within x%) parity with (equal to) its current treading price (TRDPRC_1). We are also only looking for such Options expiring within a set time window; allowing for the option 'forever', i.e.: that expire whenever after date of calculation. To do so, we 1st have to find the option in question. To find live Options, we best use the Search API. To find Expired Options we will use functions created in Haykaz's amazing articles "Finding Expired Options and Backtesting a Short Iron Condor Strategy" & "Functions to find Option RICs traded on different exchanges"

Finding Live Options (using Search API)¶

Live Options, in this context, are Options that have not expired at time of computation. To be explicit:

- 'time of calculation' refers here to the time for which the calculation is done, i.e.: if we compute today an IV for an Option as if it was 3 days ago, 'time of calculation' is 3 days ago.

- 'time of computation' refers here to the time when we are computing the values, i.e.: if we compute today an IV for an Option as if it was 3 days ago, 'time of computation' is today.

As aforementioned, to find live Options, we best use the Search API: Here we look for options on .STOXX50E that mature on the 3rd friday of December 2023:

response1 = search.Definition(

view=search.Views.SEARCH_ALL, # To see what views are available: `help(search.Views)` & `search.metadata.Definition(view = search.Views.SEARCH_ALL).get_data().data.df.to_excel("SEARCH_ALL.xlsx")`

query=".STOXX50E",

select="DocumentTitle, RIC, StrikePrice, ExchangeCode, ExpiryDate, UnderlyingAsset, " +

"UnderlyingAssetName, UnderlyingAssetRIC, ESMAUnderlyingIndexCode, RCSUnderlyingMarket" +

"UnderlyingQuoteName, UnderlyingQuoteRIC, InsertDateTime, RetireDate",

filter="RCSAssetCategoryLeaf eq 'Option' and RIC eq 'STX*' and DocumentTitle ne '*Weekly*' " +

"and CallPutOption eq 'Call' and ExchangeCode eq 'EUX' and " +

"ExpiryDate ge 2023-11-29 and ExpiryDate lt 2023-12-31", # ge (greater than or equal to), gt (greater than), lt (less than) and le (less than or equal to). These can only be applied to numeric and date properties.

top=100).get_data()

search_df1 = response1.data.df

search_df1

| DocumentTitle | RIC | StrikePrice | ExchangeCode | ExpiryDate | UnderlyingQuoteRIC | InsertDateTime | RetireDate | |

|---|---|---|---|---|---|---|---|---|

| 0 | Eurex EURO STOXX 50 Monthly Index Option 4300 ... | STXE43000L3.EX | 4300 | EUX | 2023-12-15 | [.STOXX50E] | 2023-03-09 05:27:25 | 2023-12-19 |

| 1 | Eurex EURO STOXX 50 Monthly Index Option 4500 ... | STXE45000L3.EX | 4500 | EUX | 2023-12-15 | [.STOXX50E] | 2023-03-09 05:15:11 | 2023-12-19 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 98 | Eurex EURO STOXX 50 Monthly Index Option 2800 ... | STXE28000L3.EX | 2800 | EUX | 2023-12-15 | [.STOXX50E] | 2023-03-09 05:16:35 | 2023-12-19 |

| 99 | Eurex EURO STOXX 50 Monthly Index Option 3825 ... | STXE38250L3.EX | 3825 | EUX | 2023-12-15 | [.STOXX50E] | 2023-03-09 03:51:31 | 2023-12-19 |

N.B.: When using the Filter in Search and playing with dates, it is good to read the API Playground Documentation; it mentions that: "Dates are written in ISO datetime format. The time portion is optional, as is the timezone (assumed to be UTC unless otherwise specified). Valid examples include 2012-03-11T17:13:55Z, 2012-03-11T17:13:55, 2012-03-11T12:00-03:30, 2012-03-11.":

Let's find the current underlying price, then we can pick the option with strike price closest to that, i.e.: the most 'At The Money'; note that this means that the option can be in or out the money, as long as it is the closest to at the money:

current_underlying_prc = rd.get_history(

universe=[search_df1.UnderlyingQuoteRIC[0][0]],

fields=["TRDPRC_1"],

interval="tick").iloc[-1][0]

current_underlying_prc

4212.59

optn = search_df1.iloc[(search_df1['StrikePrice']-current_underlying_prc).abs().argsort()[:1]]

optn

| DocumentTitle | RIC | StrikePrice | ExchangeCode | ExpiryDate | UnderlyingQuoteRIC | InsertDateTime | RetireDate | |

|---|---|---|---|---|---|---|---|---|

| 36 | Eurex EURO STOXX 50 Monthly Index Option 4225 ... | STXE42250L3.EX | 4225 | EUX | 2023-12-15 | [.STOXX50E] | 2023-03-09 03:51:55 | 2023-12-19 |

optn_strk_pr = optn['StrikePrice'].to_list()[0]

opn_RIC = optn['RIC'].to_list()[0]

opn_exp_date_str = str(optn.ExpiryDate.to_list()[0])[:10]

if optn_strk_pr > current_underlying_prc:

optn_explainer_a = str(

f"higher than the spot price of our underlying which is {current_underlying_prc}")

optn_explainer_b = str(

f"a loss of ({optn_strk_pr} - {current_underlying_prc} =) {optn_strk_pr - current_underlying_prc}")

moneyness = "'Out-The-Money'"

if optn_strk_pr == current_underlying_prc:

optn_explainer_a = str(

f"equal to the spot price of our underlying which is {current_underlying_prc}")

optn_explainer_b = str(

f"neither a gain or a loss [of ({current_underlying_prc} - {optn_strk_pr} =) {current_underlying_prc - optn_strk_pr}]")

moneyness = "exactly 'At-The-Money'"

if optn_strk_pr < current_underlying_prc:

optn_explainer_a = str(

f"lower than the spot price of our underlying which is {current_underlying_prc}")

optn_explainer_b = str(

f"a gain of ({current_underlying_prc} - {optn_strk_pr} =) {current_underlying_prc - optn_strk_pr}")

moneyness = "'In-The-Money'"

print(f"In this instance, for this Call Option, '{opn_RIC}', " +

f"the strike price is {optn_strk_pr},")

print(f"{optn_explainer_a}.")

print(f"The holder of this '{opn_RIC}' option has the right " +

f"(but not the obligation) to buy the underlying for {optn_strk_pr}, ")

print(f"which, was the price of the underlying to stay the same till expiry (" +

f"{current_underlying_prc} on {opn_exp_date_str}),")

print(f"means {optn_explainer_b}.")

print(f"This option, in this instance, is {moneyness}.")

In this instance, for this Call Option, 'STXE42250L3.EX', the strike price is 4225,

higher than the spot price of our underlying which is 4212.59.

The holder of this 'STXE42250L3.EX' option has the right (but not the obligation) to buy the underlying for 4225,

which, was the price of the underlying to stay the same till expiry (4212.59 on 2023-12-15),

means a loss of (4225 - 4212.59 =) 12.409999999999854.

This option, in this instance, is 'Out-The-Money'.

Function for Expiration Days¶

Most of the time, market agents will be interested in the next expiring Option, unless we are too close to it. We would not be interested, for example, in an option expiring in 1 hour, or even tomorrow, because that is so close (in time) that the information reflected in the Option's trades in the market does not represent future expectations of its underlying, but current expectations of it.

To implement such a logic, we need to know what are the expiry dates of the option that we are interested in. We are looking for a Python function narrowing our search to options expiring on the 3rd Friday of any one month. For info on this function, please read articles "Finding Expired Options and Backtesting a Short Iron Condor Strategy" & "Functions to find Option RICs traded on different exchanges"

def Get_exp_dates(year, days=True, mcal_get_calendar='EUREX'):

'''

Get_exp_dates Version 2.0:

This function gets expiration dates for a year for NDX options, which are the 3rd Fridays of each month.

Changes

----------------------------------------------

Changed from Version 1.0 to 2.0: Jonathan Legrand changed Haykaz Aramyan's original code to allow

(i) function name changed from `get_exp_dates` to `Get_exp_dates`

(ii) for the function's holiday argument to be changed, allowing for any calendar supported by `mcal.get_calendar` and defaulted to 'EUREX' as opposed to 'CBOE_Index_Options' and

(iii) for the function to output full date objects as opposed to just days of the month if agument days=True.

Dependencies

----------------------------------------------

Python library 'pandas_market_calendars' version '3.2'.

pandas_market_calendars as mcal version '4.1.0'.

Parameters

-----------------------------------------------

Input:

year(int): year for which expiration days are requested

mcal_get_calendar(str): String of the calendar for which holidays have to be taken into account. More on this calendar (link to Github checked 2022-10-11): https://github.com/rsheftel/pandas_market_calendars/blob/177e7922c7df5ad249b0d066b5c9e730a3ee8596/pandas_market_calendars/exchange_calendar_cboe.py

Default: mcal_get_calendar='EUREX'

days(bool): If True, only days of the month is outputed, else it's dataeime objects

Default: days=True

Output:

dates(dict): dictionary of expiration days for each month of a specified year in datetime.date format.

'''

# get CBOE market holidays

EUREXCal = mcal.get_calendar(mcal_get_calendar)

holidays = EUREXCal.holidays().holidays

# set calendar starting from Saturday

c = calendar.Calendar(firstweekday=calendar.SATURDAY)

# get the 3rd Friday of each month

exp_dates = {}

for i in range(1, 13):

monthcal = c.monthdatescalendar(year, i)

date = monthcal[2][-1]

# check if found date is an holiday and get the previous date if it is

if date in holidays:

date = date + timedelta(-1)

# append the date to the dictionary

if year in exp_dates:

### Changed from original code from here on by Jonathan Legrand on 2022-10-11

if days: exp_dates[year].append(date.day)

else: exp_dates[year].append(date)

else:

if days: exp_dates[year] = [date.day]

else: exp_dates[year] = [date]

return exp_dates

full_dates = Get_exp_dates(2022, days=False)

dates = Get_exp_dates(2022)

full_dates_str_dict = {i: [full_dates[i][j].strftime('%Y-%m-%d')

for j in range(len(full_dates[i]))]

for i in list(full_dates.keys())}

full_dates_day_dict = {i: [full_dates[i][j].day

for j in range(len(full_dates[i]))]

for i in list(full_dates.keys())}

print(f"full_dates: {full_dates} \n") # `\n` prints a new line

print(f"full_dates_str_dict: {full_dates_str_dict} \n")

print(f"dates: {dates} \n")

print(f"full_dates_day_dict: {full_dates_day_dict}")

full_dates: {2022: [datetime.date(2022, 1, 21), datetime.date(2022, 2, 18), datetime.date(2022, 3, 18), datetime.date(2022, 4, 14), datetime.date(2022, 5, 20), datetime.date(2022, 6, 17), datetime.date(2022, 7, 15), datetime.date(2022, 8, 19), datetime.date(2022, 9, 16), datetime.date(2022, 10, 21), datetime.date(2022, 11, 18), datetime.date(2022, 12, 16)]}

full_dates_str_dict: {2022: ['2022-01-21', '2022-02-18', '2022-03-18', '2022-04-14', '2022-05-20', '2022-06-17', '2022-07-15', '2022-08-19', '2022-09-16', '2022-10-21', '2022-11-18', '2022-12-16']}

dates: {2022: [21, 18, 18, 14, 20, 17, 15, 19, 16, 21, 18, 16]}

full_dates_day_dict: {2022: [21, 18, 18, 14, 20, 17, 15, 19, 16, 21, 18, 16]}

Function to find the next expiring Option outside the next x day window¶

Most of the time, market agents will be interested in the next expiring Option, unless we are too close to it. We would not be interested, for example, in an option expiring in 1 hour, or even tomorrow, because that is so close (in time) that the information reflected in the Option's trades in the market does not represent future expectations of its underlying, but current expectations of it.

E.g.: I would like to know what is the next Future (Monthly) Option (i) on the Index '.STOXX50E' (ii) closest to ATM (i.e.: with an underlying spot price closest to the option's strike price) (ii) Expiring in more than x days (i.e.: not too close to calculated time 't'), let's say 15 days:

x = 15

time_of_calc_datetime = datetime.now() # For now, we will focuss on the use-case where we are calculating values for today; later we will allow for it historically for any day going back a few business days.

time_of_calc_str = datetime.now().strftime('%Y-%m-%d')

time_of_calc_str

'2023-09-27'

full_dates_at_time_of_calc = Get_exp_dates(

time_of_calc_datetime.year, days=False) # `time_of_calc_datetime.year` here is 2023

full_dates_at_time_of_calc_datetime = [

datetime(i.year, i.month, i.day)

for i in full_dates_at_time_of_calc[

list(full_dates_at_time_of_calc.keys())[0]]]

print(full_dates_at_time_of_calc_datetime)

[datetime.datetime(2023, 1, 20, 0, 0), datetime.datetime(2023, 2, 17, 0, 0), datetime.datetime(2023, 3, 17, 0, 0), datetime.datetime(2023, 4, 21, 0, 0), datetime.datetime(2023, 5, 19, 0, 0), datetime.datetime(2023, 6, 16, 0, 0), datetime.datetime(2023, 7, 21, 0, 0), datetime.datetime(2023, 8, 18, 0, 0), datetime.datetime(2023, 9, 15, 0, 0), datetime.datetime(2023, 10, 20, 0, 0), datetime.datetime(2023, 11, 17, 0, 0), datetime.datetime(2023, 12, 15, 0, 0)]

expiry_date_of_int = [i for i in full_dates_at_time_of_calc_datetime

if i > time_of_calc_datetime + relativedelta(days=x)][0]

expiry_date_of_int

datetime.datetime(2023, 10, 20, 0, 0)

Now we can look for the one option we're after:

response2 = search.Definition(

view=search.Views.SEARCH_ALL, # To see what views are available: `help(search.Views)` & `search.metadata.Definition(view = search.Views.SEARCH_ALL).get_data().data.df.to_excel("SEARCH_ALL.xlsx")`

query=".STOXX50E",

select="DocumentTitle, RIC, StrikePrice, ExchangeCode, ExpiryDate, UnderlyingAsset, " +

"UnderlyingAssetName, UnderlyingAssetRIC, ESMAUnderlyingIndexCode, RCSUnderlyingMarket" +

"UnderlyingQuoteName, UnderlyingQuoteRIC, InsertDateTime, RetireDate",

filter="RCSAssetCategoryLeaf eq 'Option' and RIC eq 'STX*' and DocumentTitle ne '*Weekly*' " +

"and CallPutOption eq 'Call' and ExchangeCode eq 'EUX' and " +

f"ExpiryDate ge {(expiry_date_of_int - relativedelta(days=1)).strftime('%Y-%m-%d')} " +

f"and ExpiryDate lt {(expiry_date_of_int + relativedelta(days=1)).strftime('%Y-%m-%d')}", # ge (greater than or equal to), gt (greater than), lt (less than) and le (less than or equal to). These can only be applied to numeric and date properties.

top=10000,

).get_data()

searchDf2 = response2.data.df

searchDf2

| DocumentTitle | RIC | StrikePrice | ExchangeCode | ExpiryDate | UnderlyingQuoteRIC | InsertDateTime | RetireDate | |

|---|---|---|---|---|---|---|---|---|

| 0 | Eurex EURO STOXX 50 Monthly Index Option 4300 ... | STXE43000J3.EX | 4300 | EUX | 2023-10-20 | [.STOXX50E] | 2023-03-09 03:49:34 | 2023-10-24 |

| 1 | Eurex EURO STOXX 50 Monthly Index Option 4350 ... | STXE43500J3.EX | 4350 | EUX | 2023-10-20 | [.STOXX50E] | 2023-03-09 03:41:50 | 2023-10-24 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 154 | Eurex EURO STOXX 50 Monthly Index Option 3025 ... | STXE30250J3.EX | 3025 | EUX | 2023-10-20 | [.STOXX50E] | 2023-03-09 03:52:01 | 2023-10-24 |

| 155 | Eurex EURO STOXX 50 Monthly Index Option 1000 ... | STXE10000J3.EX | 1000 | EUX | 2023-10-20 | [.STOXX50E] | 2023-03-09 03:41:17 | 2023-10-24 |

And again, we can collect the closest to ATM:

closest_atm_optn = searchDf2.iloc[(searchDf2['StrikePrice']-current_underlying_prc).abs().argsort()[:1]]

closest_atm_optn

| DocumentTitle | RIC | StrikePrice | ExchangeCode | ExpiryDate | UnderlyingQuoteRIC | InsertDateTime | RetireDate | |

|---|---|---|---|---|---|---|---|---|

| 14 | Eurex EURO STOXX 50 Monthly Index Option 4150 ... | STXE41500J3.EX | 4150 | EUX | 2023-10-20 | [.STOXX50E] | 2023-03-09 03:48:43 | 2023-10-24 |

Now we have our instrument:

instrument = closest_atm_optn.RIC.values[0]

instrument

'STXE41500J3.EX'

Refinitiv-provided Daily Implied Volatility¶

Refinitiv provides pre-calculated Implied Volatility values, but they are daily, and we will look into calculating them in higher frequencies:

start = (time_of_calc_datetime - pd.tseries.offsets.BDay(5)).strftime('%Y-%m-%dT%H:%M:%S.%f') # `datetime.now().isoformat(timespec='minutes')`

start

'2023-09-20T10:27:45.460240'

end_date_time = datetime.now()

end = end_date_time.strftime('%Y-%m-%dT%H:%M:%S.%f') # e.g.: '2022-09-09T20:00:00.000'

end

'2023-09-27T10:27:46.761469'

_ref_daily_imp_vol_df = historical_pricing.events.Definition(

instrument, fields=['IMP_VOLT'], count=2000).get_data()

_ref_daily_imp_vol_df.data.df.head()

try:

def_daily_imp_vol_df = _ref_daily_imp_vol_df.data.df.drop(['EVENT_TYPE'], axis=1) # In codebook, this line is needed

except:

def_daily_imp_vol_df = _ref_daily_imp_vol_df.data.df # If outside of codebook

fig = px.line(

def_daily_imp_vol_df,

title = def_daily_imp_vol_df.columns.name + " " + def_daily_imp_vol_df.columns[0]) # This is just to see the implied vol graph when that field is available

fig.show()

Now things are getting tricky. Certain Expiered Options do not have TRDPRC_1 data historically. Some don't have SETTLE. Some have both... The below should capture TRDPRC_1 when it is available, but SETTLE might still be present in these instances. So we will need to build a logic to focus on the series with the most datapoints. Specifically: Get TRDPRC_1. If there are fewer TRDPRC_1 datapoionts than days (i.e.: if there's only daily data for this field), get SETTLE. Same again, if not SETTLE, then get the midpoint between BID and ASK.

__optn_mrkt_price_gmt = rd.content.historical_pricing.summaries.Definition(

universe=instrument,

start=start, # Ought to always start at 4 am for OPRA exchanged Options, more info in the article below

end=end, # Ought to always end at 8 pm for OPRA exchanged Options, more info in the article below

interval='PT10M', # `PT1M`

fields=['TRDPRC_1', 'SETTLE', 'BID', 'ASK']).get_data().data.df # 'LST_TRD_PR', 'CF_LAST', 'CF_CLOSE', 'SETTLE', 'TRDPRC_1', 'BID', 'ASK'

__optn_mrkt_price_gmt_cnt = __optn_mrkt_price_gmt.count()

if __optn_mrkt_price_gmt_cnt.TRDPRC_1 > 0:

__optn_mrkt_price_gmt = pd.DataFrame(

data={'TRDPRC_1':

__optn_mrkt_price_gmt.TRDPRC_1}).dropna()

elif __optn_mrkt_price_gmt_cnt.SETTLE > 0:

__optn_mrkt_price_gmt = pd.DataFrame(

data={'SETTLE':

__optn_mrkt_price_gmt.SETTLE}).dropna()

elif __optn_mrkt_price_gmt_cnt.BID > 0:

__optn_mrkt_price_gmt = pd.DataFrame(

data={'MID': (

__optn_mrkt_price_gmt.BID + __optn_mrkt_price_gmt.ASK)/2}).dropna()

if __optn_mrkt_price_gmt.empty:

print(f"No data could be found for {instrument}, please check it on Refinitiv Workspace")

_optn_mrkt_price_gmt = __optn_mrkt_price_gmt.copy()

_optn_mrkt_price_gmt.columns = [f"Optn {__optn_mrkt_price_gmt.columns[0]} Pr"]

_optn_mrkt_price_gmt.columns.name = instrument

_optn_mrkt_price_gmt

| STXE41500J3.EX | Optn TRDPRC_1 Pr | |

|---|---|---|

| Timestamp | ||

| 2023-09-21 10:40:00 | 119.0 | |

| 2023-09-21 11:00:00 | 120.8 | |

| ... | ... | |

| 2023-09-27 07:20:00 | 69.4 | |

| 2023-09-27 08:00:00 | 77.6 |

Underlying Asset Price

Now let's get data for the underying, which we need to calculate IV:

Note also that one may want to only look at 'At Option Trade' datapoints, i.e.: Implied Volatility when a trade is made for the Option, but not when none is made. For this, we will use the 'At Trade' (AT) dataframes:

underlying = closest_atm_optn.UnderlyingQuoteRIC.values[0][0]

underlying

'.STOXX50E'

Opening Times Of Any One Exchange

If you are interested in the opening times of any one exchange, you can use the following:

1. we can check the META App to get more information about the RIC. If we take `STXE43750H3.EX` as an example, this RIC has ".EX" which is for the exchange.

2. Use the page EXCHID01 in Workspace (can be opened via Quote app) to look up the list of exchanges. Click on EXCHID07 as it is the page for exchanges ".EA to .FX".

3. From EXCHID07, you will see there's 2 .EX exchanges, Germany and Switzerland. Referencing the additional data from the META app, the RIC's country is Germany, so use DE/EXCH10 page

4. From DE/EXCH10 page, Hours would display the information including the timezone.

5. From there, you can find the exchange info page with trading hours for Options

You may find screens like this:

by searhing 'trading hours' in the Workspace search bar (at the top), then clickin gon Speed Guides. Looking in there, I found the below:

And get the info programatically like this:

hoursDf = rd.get_data(

universe=["EUREX22"],

fields=["ROW80_22"]).iloc[0, 1]

hoursDf

' OESX/OSTX 07:30-08:50 08:50-17:30 17:30-20:30 '

There isn't nessesarily a trade every 10 min... However, for the statistical inferences that we will make further in the article, when we will calculate Implied Volatilities and therefore implement the Black Scholes model, we will need 'continuous timeseries' with which to deal. There are several ways to go from discrete time series (like ours, even if we go down to tick data), but for this article, we will 1st focus on making 'buckets' of 10 min. If no trade is made in any 10 min. bucket, we will assume the price to have stayed the same as previously, throughout the exchange's trading hours which are:

- 4am to 8pm ET for OPRA and

- typically 7:30am to 22:00 CET at the Eurex Exchange (EUREX)

thankfully this is simple. Let's stick with the EUREX for now:

optn_mrkt_price_gmt = _optn_mrkt_price_gmt.resample('10Min').mean() # get a datapoint every 10 min. Could also use `optn_mrkt_price.append(pd.DataFrame([[pd.NA]], columns=optn_mrkt_price.columns, index=[(end_date_time + (datetime.min - end_date_time) % timedelta(minutes=10))]))` as per https://stackoverflow.com/questions/32723150/rounding-up-to-nearest-30-minutes-in-python

optn_mrkt_price_gmt = optn_mrkt_price_gmt[

optn_mrkt_price_gmt.index.strftime('%Y-%m-%d').isin(

[i for i in _optn_mrkt_price_gmt.index.strftime(

'%Y-%m-%d').unique()])] # Only keep trading days

# Get timezone of the exchange where option is traded:

optn_mrkt_price = optn_mrkt_price_gmt.copy()

optn_mrkt_price.index = pd.MultiIndex.from_tuples(

[(i, j) for i, j in zip(

optn_mrkt_price_gmt.index,

optn_mrkt_price_gmt.index.tz_localize('GMT').tz_convert('Europe/Berlin'))],

names=["gmt", "cet"])

optn_mrkt_price

| STXE41500J3.EX | Optn TRDPRC_1 Pr | |

|---|---|---|

| gmt | cet | |

| 2023-09-21 10:40:00 | 2023-09-21 12:40:00+02:00 | 119.0 |

| 2023-09-21 10:50:00 | 2023-09-21 12:50:00+02:00 | <NA> |

| ... | ... | ... |

| 2023-09-27 07:50:00 | 2023-09-27 09:50:00+02:00 | <NA> |

| 2023-09-27 08:00:00 | 2023-09-27 10:00:00+02:00 | 77.6 |

# Get only trading hours

mrkt_exhng_open_time = '8:50'

mrkt_exhng_close_time = '17:30'

optn_mrkt_price_th = optn_mrkt_price.droplevel( # unfortunately, we have to drop levels we just added to apply the useful `between_time` function.

'gmt').between_time(mrkt_exhng_open_time, mrkt_exhng_close_time) # Only keep trading hours. Could also be done with `optn_mrkt_price = optn_mrkt_price.loc[(optn_mrkt_price.index.strftime('%H:%M:%S') >= '07:30:00') & (optn_mrkt_price.index.strftime('%H:%M:%S') <= '22:00:00')]`.

optn_mrkt_price_th.index = pd.MultiIndex.from_tuples(

[(i, j) for i, j in zip(

optn_mrkt_price_th.index.tz_convert('GMT'),

optn_mrkt_price_th.index)],

names=["gmt", "cet"])

optn_mrkt_price_th.fillna(method='ffill', inplace=True) # Forward Fill to populate NaN values

print(f"Our dataframe started at {str(optn_mrkt_price_th.index[0])}, \n" +

f"and went on continuously till {str(optn_mrkt_price_th.index[-1])}, \n" +

f"so out of trading hours rows are removed")

# optn_mrkt_price.columns = [optn_mrkt_price_th.columns[0] + "_OptPr"]

optn_mrkt_price_th

Our dataframe started at (Timestamp('2023-09-21 10:40:00+0000', tz='GMT'), Timestamp('2023-09-21 12:40:00+0200', tz='Europe/Berlin')),

and went on continuously till (Timestamp('2023-09-27 08:00:00+0000', tz='GMT'), Timestamp('2023-09-27 10:00:00+0200', tz='Europe/Berlin')),

so out of trading hours rows are removed

| STXE41500J3.EX | Optn TRDPRC_1 Pr | |

|---|---|---|

| gmt | cet | |

| 2023-09-21 10:40:00+00:00 | 2023-09-21 12:40:00+02:00 | 119.0 |

| 2023-09-21 10:50:00+00:00 | 2023-09-21 12:50:00+02:00 | 119.0 |

| ... | ... | ... |

| 2023-09-27 07:50:00+00:00 | 2023-09-27 09:50:00+02:00 | 69.4 |

| 2023-09-27 08:00:00+00:00 | 2023-09-27 10:00:00+02:00 | 77.6 |

Note also that one may want to only look at 'At Option Trade' datapoints, i.e.: Implied Volatility when a trade is made for the Option, but not when none is made. For this, we will use the 'At Trade' (AT) dataframes:

# Get timezone of the exchange where option is traded:

AToptn_mrkt_price = _optn_mrkt_price_gmt.copy()

AToptn_mrkt_price.index = pd.MultiIndex.from_tuples(

[(i, j) for i, j in zip(

AToptn_mrkt_price.index,

AToptn_mrkt_price.index.tz_localize('GMT').tz_convert('Europe/Berlin'))],

names=["gmt", "cet"])

# Get only trading hours

AToptn_mrkt_pr_th = AToptn_mrkt_price.droplevel('gmt').between_time(mrkt_exhng_open_time, mrkt_exhng_close_time) # Only keep trading hours. Could also be done with `optn_mrkt_price = optn_mrkt_price.loc[(optn_mrkt_price.index.strftime('%H:%M:%S') >= '07:30:00') & (optn_mrkt_price.index.strftime('%H:%M:%S') <= '22:00:00')]`.

AToptn_mrkt_pr_th.index = pd.MultiIndex.from_tuples(

[(i, j) for i, j in zip(

AToptn_mrkt_pr_th.index.tz_convert('GMT'),

AToptn_mrkt_pr_th.index)],

names=["gmt", "cet"])

AToptn_mrkt_pr_th

| STXE41500J3.EX | Optn TRDPRC_1 Pr | |

|---|---|---|

| gmt | cet | |

| 2023-09-21 10:40:00+00:00 | 2023-09-21 12:40:00+02:00 | 119.0 |

| 2023-09-21 11:00:00+00:00 | 2023-09-21 13:00:00+02:00 | 120.8 |

| ... | ... | ... |

| 2023-09-27 08:00:00+00:00 | 2023-09-27 10:00:00+02:00 | 77.6 |

Here, we can see that the EUERX index's exchange opens trading for Options at 8:50am and closes at 17:30. You can look a the TAS app on Workspace to check.

_undrlying_mrkt_pr_gmt = rd.get_history(

universe=[underlying],

fields=["TRDPRC_1"],

interval="10min",

start=start,

end=end)

_undrlying_mrkt_pr_gmt.index = _undrlying_mrkt_pr_gmt.index.tz_localize('GMT') # This unfortunutally has to be done for the `join` coming up to work.

_undrlying_mrkt_pr_gmt

| .STOXX50E | TRDPRC_1 | |

|---|---|---|

| Timestamp | ||

| 2023-09-20 10:30:00+00:00 | 4261.19 | |

| 2023-09-20 10:40:00+00:00 | 4259.89 | |

| ... | ... | |

| 2023-09-27 08:10:00+00:00 | 4147.91 | |

| 2023-09-27 08:20:00+00:00 | 4149.99 |

ATdf_th = AToptn_mrkt_pr_th.join(

_undrlying_mrkt_pr_gmt, how='inner', on=['gmt'])

ATdf_th.rename(

columns={"TRDPRC_1": 'underlying ' + underlying + ' TRDPRC_1'},

inplace=True)

ATdf_th.columns.name = instrument

ATdf_th

| STXE41500J3.EX | Optn TRDPRC_1 Pr | underlying .STOXX50E TRDPRC_1 | |

|---|---|---|---|

| gmt | cet | ||

| 2023-09-21 10:40:00+00:00 | 2023-09-21 12:40:00+02:00 | 119.0 | 4211.18 |

| 2023-09-21 11:00:00+00:00 | 2023-09-21 13:00:00+02:00 | 120.8 | 4214.9 |

| ... | ... | ... | ... |

| 2023-09-27 07:20:00+00:00 | 2023-09-27 09:20:00+02:00 | 69.4 | 4146.47 |

| 2023-09-27 08:00:00+00:00 | 2023-09-27 10:00:00+02:00 | 77.6 | 4152.58 |

Let's put it all in one data-frame, df. Some datasets will have data going from the time we sort for start all the way to end. Some won't because no trade happened in the past few minutes/hours. We ought to base ourselves on the dataset with values getting closer to end and ffill for the other column. As a result, the following if loop is needed:

df = optn_mrkt_price_th.join(

_undrlying_mrkt_pr_gmt, how='left', on=['gmt'])

df.rename(

columns={"TRDPRC_1": 'underlying ' + underlying + ' TRDPRC_1'},

inplace=True)

df.fillna(method='ffill', inplace=True)

df.fillna(method='bfill', inplace=True) # Here we backfill in case `undrlying_mrkt_pr_gmt` didn't have a value for the 1st few rows of `optn_mrkt_price_th`.

df.columns.name = instrument

# df[df['underlying ' + underlying + ' TRDPRC_1'].isna()] # Checking for NAs

df_th = df.droplevel('gmt').between_time(mrkt_exhng_open_time, mrkt_exhng_close_time) # Only keep trading hours.

df_th.index = pd.MultiIndex.from_tuples(

[(i, j) for i, j in zip(df_th.index.tz_convert('GMT'),

df_th.index)],

names=["gmt", "cet"])

df_th

| STXE41500J3.EX | Optn TRDPRC_1 Pr | underlying .STOXX50E TRDPRC_1 |

|---|---|---|

| gmt | cet | |

| 2023-09-21 10:40:00+00:00 | 2023-09-21 12:40:00+02:00 | 119.0 |

| 2023-09-21 10:50:00+00:00 | 2023-09-21 12:50:00+02:00 | 119.0 |

| ... | ... | ... |

| 2023-09-27 07:50:00+00:00 | 2023-09-27 09:50:00+02:00 | 69.4 |

| 2023-09-27 08:00:00+00:00 | 2023-09-27 10:00:00+02:00 | 77.6 |

strikePrice = closest_atm_optn.StrikePrice.values[0]

strikePrice

4150

(datetime.strptime(start, '%Y-%m-%dT%H:%M:%S.%f') - timedelta(days=1)).strftime('%Y-%m-%d')

'2023-09-19'

start

'2023-09-20T10:27:45.460240'

_eur_rf_rate = rd.get_history( # `rd.get_history` provides data in the GMT timezone

universe=['EURIBOR3MD='], # USD3MFSR=, USDSOFR=

fields=['TR.FIXINGVALUE'],

# Since we will use `dropna()` as a way to select the rows we are after later on in the code, we need to ask for more risk-free data than needed, just in case we don't have enough:

start=(datetime.strptime(start, '%Y-%m-%dT%H:%M:%S.%f') - timedelta(days=1)).strftime('%Y-%m-%d'),

end=(datetime.strptime(end, '%Y-%m-%dT%H:%M:%S.%f') + timedelta(days=1)).strftime('%Y-%m-%d'))

_eur_rf_rate

| EURIBOR3MD= | Fixing Value |

|---|---|

| Date | |

| 2023-09-19 | 3.934 |

| 2023-09-20 | 3.934 |

| 2023-09-21 | 3.955 |

| 2023-09-22 | 3.958 |

| 2023-09-25 | 3.977 |

| 2023-09-26 | 3.941 |

Euribor values are released daily at 11am CET, and it is published as such on Refinitiv:

eur_rf_rate = _eur_rf_rate.resample('10Min').mean().fillna(method='ffill')

eur_rf_rate.index = eur_rf_rate.index.tz_localize('GMT') # This unfortunutally has to be done for the `join` coming up to work.

eur_rf_rate.rename(

columns={"Fixing Value": "EurRfRate"},

inplace=True)

You might be running your code after the latest Risk Free Rate published, so the most accurate such value after taht would be the latest value, thus the use of `ffill`:

df_th = df_th.join(eur_rf_rate, how='left', on=['gmt']) # `rd.get_history` provides data in the GMT timezone, and it was used to get `eur_rf_rate`.

df_th.fillna(method='ffill', inplace=True)

df_th.columns.name = instrument

df_th.rename(columns={"Fixing Value": "EurRfRate"},

inplace=True)

df_th

| STXE41500J3.EX | Optn TRDPRC_1 Pr | underlying .STOXX50E TRDPRC_1 | EurRfRate |

|---|---|---|---|

| gmt | cet | ||

| 2023-09-21 10:40:00+00:00 | 2023-09-21 12:40:00+02:00 | 119.0 | 4211.18 |

| 2023-09-21 10:50:00+00:00 | 2023-09-21 12:50:00+02:00 | 119.0 | 4214.46 |

| ... | ... | ... | ... |

| 2023-09-27 07:50:00+00:00 | 2023-09-27 09:50:00+02:00 | 69.4 | 4146.58 |

| 2023-09-27 08:00:00+00:00 | 2023-09-27 10:00:00+02:00 | 77.6 | 4152.58 |

# pd.options.mode.chained_assignment = None # default='warn'

# AT_undrlying_mrkt_pr_gmt['EurRfRate'] = [pd.NA for i in AT_undrlying_mrkt_pr_gmt.index]

# for i in _eur_rf_rate.index:

# _i = str(i)[:10]

# for n, j in enumerate(AT_undrlying_mrkt_pr_gmt.index):

# if _i in str(j):

# if len(_eur_rf_rate.loc[i].values) == 2:

# AT_undrlying_mrkt_pr_gmt['EurRfRate'].iloc[n] = _eur_rf_rate.loc[i].values[0][0]

# elif len(_eur_rf_rate.loc[i].values) == 1:

# AT_undrlying_mrkt_pr_gmt['EurRfRate'].iloc[n] = _eur_rf_rate.loc[i].values[0]

# ATdf = AT_undrlying_mrkt_pr_gmt.copy()

# ATdf = ATdf.fillna(method='ffill')

# ATdf.head(2)

Annualized Continuous Dividend Rate

We are going to assume no dividends.

Calculating IV

On the Developer Portal, one can see documentation about the Instrument Pricing Analytics service that allows access to calculating functions (that use to be called 'AdFin'). This service is accessible via several RESTful endpoints (in a family of endpoints called 'Quantitative Analytics') which can be used via RD. However, while we are going to build towards a Class that will put all our concepts together, I 1st want to showcase the several ways in which we can collect the data we're are after, for (i) all trades & (ii) at option trades only (i.e.: not every trade of the underlying) and (a) using the RD delivery layer & (b) the RD content layer:

Data returned this far was time-stamped in the GMT Time Zone, we need to re-calibrate it to the timezone of our machine:

request_fields = [ # This is the 'normal' set of fields.

"MarketValueInDealCcy", "RiskFreeRatePercent",

"UnderlyingPrice", "PricingModelType",

"DividendType", "UnderlyingTimeStamp",

"ReportCcy", "VolatilityType",

"Volatility", "DeltaPercent",

"GammaPercent", "RhoPercent",

"ThetaPercent", "VegaPercent"]

request_fields = sorted([ # This is the 'troubleshooting' set of fields.

'ErrorMessage', 'InstrumentTag', 'InstrumentCode', 'InstrumentDescription', 'EndDate', 'OptionType', 'ExerciseStyle', 'CallPut', 'DealCcy', 'LotSize', 'LotsUnits', 'UnderlyingRIC', 'UnderlyingCcy', 'ValuationDate', 'MarketDataDate', 'DaysToExpiry', 'YearsToExpiry', 'Strike', 'OptionPrice', 'OptionPriceSide', 'VolatilityType', 'Volatility', 'GammaAmountInDealCcy', 'RhoAmountInDealCcy'])

universeL = [

{

"instrumentType": "Option",

"instrumentDefinition": {

"buySell": "Buy",

"underlyingType": "Eti",

"instrumentCode": instrument,

"strike": str(strikePrice),

},

"pricingParameters": {

"valuationDate": str( # IPA works on GMT timezone, so let's stick to it.

df_th.index[i][0]).replace(" ", "T").split("+", 1)[0] + "Z", # optional, date-time # The original `df_th` index provides dates in the form of '2023-06-15 15:40:00+01:00', so here we (i) change spaces with T, (ii) keep only the part of the str before the "+" and (iii) add "Z" at the end. N.B.: Another way to get the right timezone would be `str([i for i in df_th.index[0] if str(i.tz) == 'GMT'][0].replace(" ", "T").split("+", 1)[0] + "Z")`

"marketValueInDealCcy": str(df_th.iloc[:,0][i]),

"riskFreeRatePercent": str(df_th['EurRfRate'][i]),

"underlyingPrice": str(

df_th['underlying ' + underlying + ' TRDPRC_1'][i]),

"pricingModelType": "BlackScholes",

"dividendType": "ImpliedYield",

"volatilityType": "Implied",

"underlyingTimeStamp": "Default",

"reportCcy": "EUR"

}

}

for i in range(len(df_th))]

IPA can only accept up to 100 request at a time. If there are more elements in our request list, we need to 'chunk' it:

def Chunks(lst, n):

"""Yield successive n-sized chunks from lst."""

for i in range(0, len(lst), n):

yield lst[i:i + n]

This is the cell, next coming up below, that has a rather high chance of failing. This is because there is no error handling of any kind, just in case there are issues on the servers where we are retreiving data. The Content Layer functions do have such error handing steps, and therefore is considerably less likely to fail or run into errors.

def Fin_Contracts_Chunk_Calls_Delivery_Lay(

req_univ,

batch_of=100,

dl=rd,

endpoint='https://api.refinitiv.com/data/quantitative-analytics/v1/financial-contracts',

request_fields=[

"MarketValueInDealCcy", "RiskFreeRatePercent", "UnderlyingPrice", "PricingModelType",

"DividendType", "UnderlyingTimeStamp", "ReportCcy", "VolatilityType", "Volatility",

"DeltaPercent", "GammaPercent", "RhoPercent", "ThetaPercent", "VegaPercent"],

request_outputs=["Data", "Headers"],

print_log=True):

def Chunks(lst, n):

"""Yield successive n-sized chunks from lst."""

for i in range(0, len(lst), n):

yield lst[i:i + n]

for i, j in enumerate(Chunks(req_univ, batch_of)):

if print_log:

print(f"Batch of {batch_of} requests no. {str(i+1)}/{str(len([i for i in Chunks(req_univ, batch_of)]))} started")

request_definition = dl.delivery.endpoint_request.Definition(

method=dl.delivery.endpoint_request.RequestMethod.POST,

url=endpoint,

body_parameters={

"fields": request_fields,

"outputs": request_outputs,

"universe": j})

resp = request_definition.get_data()

if resp.is_success:

headers_name = [h['name'] for h in resp.data.raw['headers']]

if i == 0:

resp_df = pd.DataFrame(

data=resp.data.raw['data'], columns=headers_name)

else:

_resp_df = pd.DataFrame(

data=resp.data.raw['data'], columns=headers_name)

resp_df = _resp_df.append(_resp_df, ignore_index=True)

if print_log:

print(f"Batch of {batch_of} requests no. {str(i+1)}/{str(len([i for i in Chunks(req_univ, batch_of)]))} ended")

else:

display(resp)

return resp_df

response3df = Fin_Contracts_Chunk_Calls_Delivery_Lay(

req_univ=universeL, request_fields=request_fields)

Batch of 100 requests no. 1/2 started

Batch of 100 requests no. 1/2 ended

Batch of 100 requests no. 2/2 started

Batch of 100 requests no. 2/2 ended

response3df.tail(3)

| AverageSoFar | AverageType | BarrierLevel | BarrierType | BreakEvenDeltaAmountInDealCcy | BreakEvenDeltaAmountInReportCcy | BreakEvenPriceInDealCcy | BreakEvenPriceInReportCcy | CallPut | CbbcOptionType | ... | VegaAmountInReportCcy | VegaPercent | Volatility | VolatilityPercent | VolatilityType | VolgaAmountInDealCcy | VolgaAmountInReportCcy | YearsToExpiry | ZommaAmountInDealCcy | ZommaAmountInReportCcy |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 191 | None | NaN | None | 0.355624 | 0.355624 | 4219.4 | 4219.4 | CALL | ... | 41.166987 | 4.116699 | 16.692590 | 16.692590 | Calculated | -0.919557 | -0.919557 | 0.063014 | -0.013864 | ||

| 192 | None | NaN | None | 0.360421 | 0.360421 | 4219.4 | 4219.4 | CALL | ... | 41.159331 | 4.115933 | 16.120708 | 16.120708 | Calculated | 2.189009 | 2.189009 | 0.063014 | -0.014816 | ||

| 193 | None | NaN | None | 0.366663 | 0.366663 | 4227.6 | 4227.6 | CALL | ... | 41.116616 | 4.111662 | 17.345784 | 17.345784 | Calculated | 9.356929 | 9.356929 | 0.063014 | -0.012711 |

Content Layer

As may (or may not) have been apparent aboe, the delivery layer does not offer any error hendling management. The server where we're requestig for data may be busy, so we may get unsuccessful messages back. You could build error handing logic yourself, but let's not reinvent the wheel when the RD Python Library exists!

def Fin_Contracts_Chunk_Calls_Content_Lay(

req_univ,

batch_of=100,

rdf=rdf,

request_fields=[

"MarketValueInDealCcy", "RiskFreeRatePercent", "UnderlyingPrice", "PricingModelType",

"DividendType", "UnderlyingTimeStamp", "ReportCcy", "VolatilityType", "Volatility",

"DeltaPercent", "GammaPercent", "RhoPercent", "ThetaPercent", "VegaPercent"],

print_log=True):

for i, j in enumerate(Chunks(req_univ, batch_of)):

if print_log:

print(f"Batch of {len(j)} requests no. {i+1}/{len([i for i in Chunks(req_univ, batch_of)])} started")

resp = rdf.Definitions(universe=j, fields=request_fields)

resp = resp.get_data()

if i == 0:

resp_df = resp.data.df

else:

resp_df = resp_df.append(resp.data.df, ignore_index=True)

if print_log:

# print(resp.request_message)

# print(resp.http_response)

# print(resp.__dict__)

print(f"Batch of {len(j)} requests no. {i+1}/{len([i for i in Chunks(req_univ, batch_of)])} ended")

return resp_df

CuniverseL = [ # C here is for the fact that we're using the content layer

option.Definition(

underlying_type=option.UnderlyingType.ETI,

buy_sell='Buy',

instrument_code=instrument,

strike=float(strikePrice),

pricing_parameters=option.PricingParameters(

valuation_date=str(df_th.index[i][0]).replace(" ", "T").split("+", 1)[0] + "Z", # optional, str # The date at which the instrument is valued. The value is expressed in iso 8601 format: yyyy-mm-ddt[hh]:[mm]:[ss]z (e.g., '2021-01-01t00:00:00z'). by default, marketdatadate is used. If marketdatadate is not specified, the default value is today.

market_value_in_deal_ccy=float(df_th.iloc[:,0][i]),

risk_free_rate_percent=float(df_th['EurRfRate'][i]),

underlying_price=float(df_th[

'underlying ' + underlying + ' TRDPRC_1'][i]),

pricing_model_type='BlackScholes',

volatility_type='Implied',

underlying_time_stamp='Default',

report_ccy='EUR'))

for i in range(len(df_th))]

response4df = Fin_Contracts_Chunk_Calls_Content_Lay(

req_univ=CuniverseL, request_fields=request_fields)

Batch of 100 requests no. 1/2 started

Batch of 100 requests no. 1/2 ended

Batch of 97 requests no. 2/2 started

Batch of 97 requests no. 2/2 ended

pd.set_option('display.max_columns', None)

response4df

| AverageSoFar | AverageType | BarrierLevel | BarrierType | BreakEvenDeltaAmountInDealCcy | BreakEvenDeltaAmountInReportCcy | BreakEvenPriceInDealCcy | BreakEvenPriceInReportCcy | CallPut | CbbcOptionType | CbbcType | CharmAmountInDealCcy | CharmAmountInReportCcy | ColorAmountInDealCcy | ColorAmountInReportCcy | ConversionRatio | DailyVolatility | DailyVolatilityPercent | DaysToExpiry | DealCcy | DeltaAmountInDealCcy | DeltaAmountInReportCcy | DeltaExposureInDealCcy | DeltaExposureInReportCcy | DeltaHedgePositionInDealCcy | DeltaHedgePositionInReportCcy | DeltaPercent | DividendType | DividendYieldPercent | DvegaDtimeAmountInDealCcy | DvegaDtimeAmountInReportCcy | EndDate | ErrorMessage | ExerciseStyle | FixingCalendar | FixingDateArray | FixingEndDate | FixingFrequency | FixingNumbers | FixingStartDate | ForecastDividendYieldPercent | GammaAmountInDealCcy | GammaAmountInReportCcy | GammaPercent | Gearing | HedgeRatio | InstrumentCode | InstrumentDescription | InstrumentTag | Leverage | LotSize | LotsUnits | MarketDataDate | MarketValueInDealCcy | MoneynessAmountInDealCcy | MoneynessAmountInReportCcy | OptionPrice | OptionPriceSide | OptionTimeStamp | OptionType | PremiumOverCashInDealCcy | PremiumOverCashInReportCcy | PremiumOverCashPercent | PremiumPerAnnumInDealCcy | PremiumPerAnnumInReportCcy | PremiumPerAnnumPercent | PremiumPercent | PricingModelType | PricingModelTypeList | ResidualAmountInDealCcy | ResidualAmountInReportCcy | RhoAmountInDealCcy | RhoAmountInReportCcy | RhoPercent | RiskFreeRatePercent | SevenDaysThetaAmountInDealCcy | SevenDaysThetaAmountInReportCcy | SevenDaysThetaPercent | SpeedAmountInDealCcy | SpeedAmountInReportCcy | Strike | ThetaAmountInDealCcy | ThetaAmountInReportCcy | ThetaPercent | TimeValueInDealCcy | TimeValueInReportCcy | TimeValuePerDay | TimeValuePercent | TotalMarketValueInDealCcy | TotalMarketValueInDealCcy | TotalMarketValueInReportCcy | TotalMarketValueInReportCcy | UltimaAmountInDealCcy | UltimaAmountInReportCcy | UnderlyingCcy | UnderlyingPrice | UnderlyingPriceSide | UnderlyingRIC | UnderlyingTimeStamp | ValuationDate | VannaAmountInDealCcy | VannaAmountInReportCcy | VegaAmountInDealCcy | VegaAmountInReportCcy | VegaPercent | Volatility | VolatilityPercent | VolatilityType | VolgaAmountInDealCcy | VolgaAmountInReportCcy | YearsToExpiry | ZommaAmountInDealCcy | ZommaAmountInReportCcy | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | <NA> | NaN | None | 0.405318 | 0.405318 | 4269.0 | 4269.0 | CALL | <NA> | -0.640398 | -0.640398 | -0.010471 | -0.010471 | 0 | 1.137092 | 1.137092 | 29 | EUR | 6.25043 | 6.25043 | -6.25043 | -6.25043 | -26321.686034 | -26321.686034 | 0.625043 | HistoricalYield | 3.36275 | -3063.740497 | -3063.740497 | 2023-10-20 | EURO | <NA> | <NA> | NaT | <NA> | 0 | NaT | <NA> | 0.017762 | 0.017762 | 0.001776 | 35.388067 | -1.59989 | STXE41500J3.EX | IndexOption_EURO_STXE41500J3.EX | <NA> | 22.119064 | 10 | UNITS | 2023-09-21 10:40:00 | 119.0 | 101.474217 | 101.474217 | 119.0 | User | Default | Vanilla | 57.82 | 57.82 | 1.373012 | 727.734483 | 727.734483 | 17.281011 | 2.825811 | BlackScholes | [BlackScholes, Binomial] | 0 | 0 | 19.661623 | 19.661623 | 1.966162 | 3.955 | -100.137886 | -100.137886 | -10.013789 | -0.000003 | -0.000003 | 4150 | -14.305412 | -14.305412 | -1.430541 | 57.82 | 57.82 | 0.000473 | 1.373012 | 1190 | 1190 | 1190 | 1190 | -3536.388733 | -3536.388733 | EUR | 4211.18 | User | .STOXX50E | Default | 2023-09-21 10:40:00 | -0.570353 | -0.570353 | 44.483776 | 44.483776 | 4.448378 | 18.050781 | 18.050781 | Calculated | 217.060823 | 217.060823 | 0.079452 | -0.008973 | -0.008973 | |||

| 1 | <NA> | NaN | None | 0.408508 | 0.408508 | 4269.0 | 4269.0 | CALL | <NA> | -0.693442 | -0.693442 | -0.010495 | -0.010495 | 0 | 1.107898 | 1.107898 | 29 | EUR | 6.337198 | 6.337198 | -6.337198 | -6.337198 | -26707.86898 | -26707.86898 | 0.63372 | HistoricalYield | 3.36275 | -3083.046904 | -3083.046904 | 2023-10-20 | EURO | <NA> | <NA> | NaT | <NA> | 0 | NaT | <NA> | 0.018078 | 0.018078 | 0.001808 | 35.41563 | -1.577984 | STXE41500J3.EX | IndexOption_EURO_STXE41500J3.EX | <NA> | 22.443587 | 10 | UNITS | 2023-09-21 10:50:00 | 119.0 | 101.553253 | 101.553253 | 119.0 | User | Default | Vanilla | 54.54 | 54.54 | 1.294116 | 686.451724 | 686.451724 | 16.288011 | 2.823612 | BlackScholes | [BlackScholes, Binomial] | 0 | 0 | 19.958896 | 19.958896 | 1.99589 | 3.955 | -96.997814 | -96.997814 | -9.699781 | -0.000003 | -0.000003 | 4150 | -13.856831 | -13.856831 | -1.385683 | 54.54 | 54.54 | 0.000446 | 1.294116 | 1190 | 1190 | 1190 | 1190 | -4287.69038 | -4287.69038 | EUR | 4214.46 | User | .STOXX50E | Default | 2023-09-21 10:50:00 | -0.632799 | -0.632799 | 44.170843 | 44.170843 | 4.417084 | 17.587328 | 17.587328 | Calculated | 258.185203 | 258.185203 | 0.079452 | -0.009223 | -0.009223 | |||

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 196 | <NA> | NaN | None | 0.366663 | 0.366663 | 4227.6 | 4227.6 | CALL | <NA> | 0.188226 | 0.188226 | -0.017922 | -0.017922 | 0 | 1.092682 | 1.092682 | 23 | EUR | 5.349917 | 5.349917 | -5.349917 | -5.349917 | -22215.958173 | -22215.958173 | 0.534992 | ImpliedYield | 0.276 | -3292.071586 | -3292.071586 | 2023-10-20 | EURO | <NA> | <NA> | NaT | <NA> | 0 | NaT | <NA> | 0.022136 | 0.022136 | 0.002214 | 53.512629 | -1.869188 | STXE41500J3.EX | IndexOption_EURO_STXE41500J3.EX | <NA> | 28.628812 | 10 | UNITS | 2023-09-27 08:00:00 | 77.6 | 100.062169 | 100.062169 | 77.6 | User | Default | Vanilla | 75.02 | 75.02 | 1.806588 | 1190.534783 | 1190.534783 | 28.669762 | 1.868718 | BlackScholes | [BlackScholes, Binomial] | 0 | 0 | 13.314312 | 13.314312 | 1.331431 | 3.977 | -124.986257 | -124.986257 | -12.498626 | -0.000002 | -0.000002 | 4150 | -17.85518 | -17.85518 | -1.785518 | 75.02 | 75.02 | 0.000785 | 1.806588 | 776 | 776 | 776 | 776 | -187.151273 | -187.151273 | EUR | 4152.58 | User | .STOXX50E | Default | 2023-09-27 08:00:00 | -0.102687 | -0.102687 | 41.116616 | 41.116616 | 4.111662 | 17.345784 | 17.345784 | Calculated | 9.356929 | 9.356929 | 0.063014 | -0.012711 | -0.012711 |

IPADf = response4df.copy() # IPA here stands for the service we used to get all the calculated valuse, Instrument Pricint Analitycs.

IPADf.index = df_th.index

IPADf.columns.name = df_th.columns.name

IPADf.rename(inplace=True, columns={

"Volatility": 'ImpliedVolatility',

"MarketValueInDealCcy": f"OptnMrktValueInDealCcy-{__optn_mrkt_price_gmt.columns[0]}"})

IPADf

| STXE41500J3.EX | AverageSoFar | AverageType | BarrierLevel | BarrierType | BreakEvenDeltaAmountInDealCcy | BreakEvenDeltaAmountInReportCcy | BreakEvenPriceInDealCcy | BreakEvenPriceInReportCcy | CallPut | CbbcOptionType | CbbcType | CharmAmountInDealCcy | CharmAmountInReportCcy | ColorAmountInDealCcy | ColorAmountInReportCcy | ConversionRatio | DailyVolatility | DailyVolatilityPercent | DaysToExpiry | DealCcy | DeltaAmountInDealCcy | DeltaAmountInReportCcy | DeltaExposureInDealCcy | DeltaExposureInReportCcy | DeltaHedgePositionInDealCcy | DeltaHedgePositionInReportCcy | DeltaPercent | DividendType | DividendYieldPercent | DvegaDtimeAmountInDealCcy | DvegaDtimeAmountInReportCcy | EndDate | ErrorMessage | ExerciseStyle | FixingCalendar | FixingDateArray | FixingEndDate | FixingFrequency | FixingNumbers | FixingStartDate | ForecastDividendYieldPercent | GammaAmountInDealCcy | GammaAmountInReportCcy | GammaPercent | Gearing | HedgeRatio | InstrumentCode | InstrumentDescription | InstrumentTag | Leverage | LotSize | LotsUnits | MarketDataDate | OptnMrktValueInDealCcy-TRDPRC_1 | MoneynessAmountInDealCcy | MoneynessAmountInReportCcy | OptionPrice | OptionPriceSide | OptionTimeStamp | OptionType | PremiumOverCashInDealCcy | PremiumOverCashInReportCcy | PremiumOverCashPercent | PremiumPerAnnumInDealCcy | PremiumPerAnnumInReportCcy | PremiumPerAnnumPercent | PremiumPercent | PricingModelType | PricingModelTypeList | ResidualAmountInDealCcy | ResidualAmountInReportCcy | RhoAmountInDealCcy | RhoAmountInReportCcy | RhoPercent | RiskFreeRatePercent | SevenDaysThetaAmountInDealCcy | SevenDaysThetaAmountInReportCcy | SevenDaysThetaPercent | SpeedAmountInDealCcy | SpeedAmountInReportCcy | Strike | ThetaAmountInDealCcy | ThetaAmountInReportCcy | ThetaPercent | TimeValueInDealCcy | TimeValueInReportCcy | TimeValuePerDay | TimeValuePercent | TotalMarketValueInDealCcy | TotalMarketValueInDealCcy | TotalMarketValueInReportCcy | TotalMarketValueInReportCcy | UltimaAmountInDealCcy | UltimaAmountInReportCcy | UnderlyingCcy | UnderlyingPrice | UnderlyingPriceSide | UnderlyingRIC | UnderlyingTimeStamp | ValuationDate | VannaAmountInDealCcy | VannaAmountInReportCcy | VegaAmountInDealCcy | VegaAmountInReportCcy | VegaPercent | ImpliedVolatility | VolatilityPercent | VolatilityType | VolgaAmountInDealCcy | VolgaAmountInReportCcy | YearsToExpiry | ZommaAmountInDealCcy | ZommaAmountInReportCcy | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| gmt | cet | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2023-09-21 10:40:00+00:00 | 2023-09-21 12:40:00+02:00 | <NA> | NaN | None | 0.405318 | 0.405318 | 4269.0 | 4269.0 | CALL | <NA> | -0.640398 | -0.640398 | -0.010471 | -0.010471 | 0 | 1.137092 | 1.137092 | 29 | EUR | 6.25043 | 6.25043 | -6.25043 | -6.25043 | -26321.686034 | -26321.686034 | 0.625043 | HistoricalYield | 3.36275 | -3063.740497 | -3063.740497 | 2023-10-20 | EURO | <NA> | <NA> | NaT | <NA> | 0 | NaT | <NA> | 0.017762 | 0.017762 | 0.001776 | 35.388067 | -1.59989 | STXE41500J3.EX | IndexOption_EURO_STXE41500J3.EX | <NA> | 22.119064 | 10 | UNITS | 2023-09-21 10:40:00 | 119.0 | 101.474217 | 101.474217 | 119.0 | User | Default | Vanilla | 57.82 | 57.82 | 1.373012 | 727.734483 | 727.734483 | 17.281011 | 2.825811 | BlackScholes | [BlackScholes, Binomial] | 0 | 0 | 19.661623 | 19.661623 | 1.966162 | 3.955 | -100.137886 | -100.137886 | -10.013789 | -0.000003 | -0.000003 | 4150 | -14.305412 | -14.305412 | -1.430541 | 57.82 | 57.82 | 0.000473 | 1.373012 | 1190 | 1190 | 1190 | 1190 | -3536.388733 | -3536.388733 | EUR | 4211.18 | User | .STOXX50E | Default | 2023-09-21 10:40:00 | -0.570353 | -0.570353 | 44.483776 | 44.483776 | 4.448378 | 18.050781 | 18.050781 | Calculated | 217.060823 | 217.060823 | 0.079452 | -0.008973 | -0.008973 | |||

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 2023-09-27 08:00:00+00:00 | 2023-09-27 10:00:00+02:00 | <NA> | NaN | None | 0.366663 | 0.366663 | 4227.6 | 4227.6 | CALL | <NA> | 0.188226 | 0.188226 | -0.017922 | -0.017922 | 0 | 1.092682 | 1.092682 | 23 | EUR | 5.349917 | 5.349917 | -5.349917 | -5.349917 | -22215.958173 | -22215.958173 | 0.534992 | ImpliedYield | 0.276 | -3292.071586 | -3292.071586 | 2023-10-20 | EURO | <NA> | <NA> | NaT | <NA> | 0 | NaT | <NA> | 0.022136 | 0.022136 | 0.002214 | 53.512629 | -1.869188 | STXE41500J3.EX | IndexOption_EURO_STXE41500J3.EX | <NA> | 28.628812 | 10 | UNITS | 2023-09-27 08:00:00 | 77.6 | 100.062169 | 100.062169 | 77.6 | User | Default | Vanilla | 75.02 | 75.02 | 1.806588 | 1190.534783 | 1190.534783 | 28.669762 | 1.868718 | BlackScholes | [BlackScholes, Binomial] | 0 | 0 | 13.314312 | 13.314312 | 1.331431 | 3.977 | -124.986257 | -124.986257 | -12.498626 | -0.000002 | -0.000002 | 4150 | -17.85518 | -17.85518 | -1.785518 | 75.02 | 75.02 | 0.000785 | 1.806588 | 776 | 776 | 776 | 776 | -187.151273 | -187.151273 | EUR | 4152.58 | User | .STOXX50E | Default | 2023-09-27 08:00:00 | -0.102687 | -0.102687 | 41.116616 | 41.116616 | 4.111662 | 17.345784 | 17.345784 | Calculated | 9.356929 | 9.356929 | 0.063014 | -0.012711 | -0.012711 |

response5df = Fin_Contracts_Chunk_Calls_Delivery_Lay(

req_univ=[{

"instrumentType": "Option",

"instrumentDefinition": {

"buySell": "Buy",

"underlyingType": "Eti",

"instrumentCode": instrument,

"strike": str(strikePrice)},

"pricingParameters": {

"valuationDate": str(

ATdf_th.index[i][0]).replace(" ", "T").split("+", 1)[0] + "Z", # optional, date-time # The original `dfLocalTimeZone` index provides dates in the form of '2023-06-15 15:40:00+01:00', so here we (i) change spaces with T, (ii) keep only the part of the str before the "+" and (iii) add "Z" at the end.

"marketValueInDealCcy": str(ATdf_th.iloc[:,0][i]),

"riskFreeRatePercent": str(ATdf_th['EurRfRate'][i]),

"underlyingPrice": str(

ATdf_th['underlying ' + underlying + ' TRDPRC_1'][i]),

"pricingModelType": "BlackScholes",

"dividendType": "ImpliedYield",

"volatilityType": "Implied",

"underlyingTimeStamp": "Default",

"reportCcy": "EUR"}}

for i in range(len(ATdf_th))],

request_fields=request_fields)

Batch of 100 requests no. 1/1 started

Batch of 100 requests no. 1/1 ended

response5df.tail(3)

| AverageSoFar | AverageType | BarrierLevel | BarrierType | BreakEvenDeltaAmountInDealCcy | BreakEvenDeltaAmountInReportCcy | BreakEvenPriceInDealCcy | BreakEvenPriceInReportCcy | CallPut | CbbcOptionType | CbbcType | CharmAmountInDealCcy | CharmAmountInReportCcy | ColorAmountInDealCcy | ColorAmountInReportCcy | ConversionRatio | DailyVolatility | DailyVolatilityPercent | DaysToExpiry | DealCcy | DeltaAmountInDealCcy | DeltaAmountInReportCcy | DeltaExposureInDealCcy | DeltaExposureInReportCcy | DeltaHedgePositionInDealCcy | DeltaHedgePositionInReportCcy | DeltaPercent | DividendType | DividendYieldPercent | DvegaDtimeAmountInDealCcy | DvegaDtimeAmountInReportCcy | EndDate | ErrorMessage | ExerciseStyle | FixingCalendar | FixingDateArray | FixingEndDate | FixingFrequency | FixingNumbers | FixingStartDate | ForecastDividendYieldPercent | GammaAmountInDealCcy | GammaAmountInReportCcy | GammaPercent | Gearing | HedgeRatio | InstrumentCode | InstrumentDescription | InstrumentTag | Leverage | LotSize | LotsUnits | MarketDataDate | MarketValueInDealCcy | MoneynessAmountInDealCcy | MoneynessAmountInReportCcy | OptionPrice | OptionPriceSide | OptionTimeStamp | OptionType | PremiumOverCashInDealCcy | PremiumOverCashInReportCcy | PremiumOverCashPercent | PremiumPerAnnumInDealCcy | PremiumPerAnnumInReportCcy | PremiumPerAnnumPercent | PremiumPercent | PricingModelType | PricingModelTypeList | ResidualAmountInDealCcy | ResidualAmountInReportCcy | RhoAmountInDealCcy | RhoAmountInReportCcy | RhoPercent | RiskFreeRatePercent | SevenDaysThetaAmountInDealCcy | SevenDaysThetaAmountInReportCcy | SevenDaysThetaPercent | SpeedAmountInDealCcy | SpeedAmountInReportCcy | Strike | ThetaAmountInDealCcy | ThetaAmountInReportCcy | ThetaPercent | TimeValueInDealCcy | TimeValueInReportCcy | TimeValuePerDay | TimeValuePercent | TotalMarketValueInDealCcy | TotalMarketValueInDealCcy | TotalMarketValueInReportCcy | TotalMarketValueInReportCcy | UltimaAmountInDealCcy | UltimaAmountInReportCcy | UnderlyingCcy | UnderlyingPrice | UnderlyingPriceSide | UnderlyingRIC | UnderlyingTimeStamp | ValuationDate | VannaAmountInDealCcy | VannaAmountInReportCcy | VegaAmountInDealCcy | VegaAmountInReportCcy | VegaPercent | Volatility | VolatilityPercent | VolatilityType | VolgaAmountInDealCcy | VolgaAmountInReportCcy | YearsToExpiry | ZommaAmountInDealCcy | ZommaAmountInReportCcy | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 41 | None | NaN | None | 0.347016 | 0.347016 | 4218.6 | 4218.6 | CALL | None | 0.528664 | 0.528664 | -0.017678 | -0.017678 | 0.0 | 1.105255 | 1.105255 | 23.0 | EUR | 4.925191 | 4.925191 | -4.925191 | -4.925191 | -20357.489414 | -20357.489414 | 0.492519 | ImpliedYield | 0.276 | -3313.848835 | -3313.848835 | 2023-10-20T00:00:00Z | EURO | None | None | None | None | 0.0 | None | None | 0.022050 | 0.022050 | 0.002205 | 60.252770 | -2.030378 | STXE41500J3.EX | IndexOption_EURO_STXE41500J3.EX | None | 29.675641 | 10.0 | UNITS | 2023-09-27T07:10:00Z | 68.6 | 99.598554 | 99.598554 | 68.6 | User | Default | Vanilla | 85.26 | 85.26 | 2.062739 | 1353.039130 | 1353.039130 | 32.734765 | 1.659675 | BlackScholes | [BlackScholes, Binomial] | 0.0 | 0.0 | 12.234798 | 12.234798 | 1.223480 | 3.977 | -124.839444 | -124.839444 | -12.483944 | -3.074284e-07 | -3.074284e-07 | 4150.0 | -17.834206 | -17.834206 | -1.783421 | 68.60 | 68.60 | 0.000722 | 1.659675 | 686.0 | 686.0 | 686.0 | 686.0 | -71.824334 | -71.824334 | EUR | 4133.34 | User | .STOXX50E | Default | 2023-09-27T07:10:00Z | 0.141601 | 0.141601 | 41.109461 | 41.109461 | 4.110946 | 17.545386 | 17.545386 | Calculated | 2.706310 | 2.706310 | 0.063014 | -0.012553 | -0.012553 | |||

| 42 | None | NaN | None | 0.360312 | 0.360312 | 4219.4 | 4219.4 | CALL | None | 0.310198 | 0.310198 | -0.019318 | -0.019318 | 0.0 | 1.015855 | 1.015855 | 23.0 | EUR | 5.218328 | 5.218328 | -5.218328 | -5.218328 | -21637.639606 | -21637.639606 | 0.521833 | ImpliedYield | 0.276 | -3292.569362 | -3292.569362 | 2023-10-20T00:00:00Z | EURO | None | None | None | None | 0.0 | None | None | 0.023887 | 0.023887 | 0.002389 | 59.747406 | -1.916323 | STXE41500J3.EX | IndexOption_EURO_STXE41500J3.EX | None | 31.178155 | 10.0 | UNITS | 2023-09-27T07:20:00Z | 69.4 | 99.914940 | 99.914940 | 69.4 | User | Default | Vanilla | 72.93 | 72.93 | 1.758845 | 1157.367391 | 1157.367391 | 27.912113 | 1.673713 | BlackScholes | [BlackScholes, Binomial] | 0.0 | 0.0 | 13.022035 | 13.022035 | 1.302203 | 3.977 | -116.931367 | -116.931367 | -11.693137 | -1.363708e-06 | -1.363708e-06 | 4150.0 | -16.704481 | -16.704481 | -1.670448 | 69.40 | 69.40 | 0.000728 | 1.673713 | 694.0 | 694.0 | 694.0 | 694.0 | -64.161454 | -64.161454 | EUR | 4146.47 | User | .STOXX50E | Default | 2023-09-27T07:20:00Z | -0.036472 | -0.036472 | 41.178550 | 41.178550 | 4.117855 | 16.126200 | 16.126200 | Calculated | 2.073210 | 2.073210 | 0.063014 | -0.014800 | -0.014800 | |||

| 43 | None | NaN | None | 0.366663 | 0.366663 | 4227.6 | 4227.6 | CALL | None | 0.188226 | 0.188226 | -0.017922 | -0.017922 | 0.0 | 1.092682 | 1.092682 | 23.0 | EUR | 5.349917 | 5.349917 | -5.349917 | -5.349917 | -22215.958173 | -22215.958173 | 0.534992 | ImpliedYield | 0.276 | -3292.071586 | -3292.071586 | 2023-10-20T00:00:00Z | EURO | None | None | None | None | 0.0 | None | None | 0.022136 | 0.022136 | 0.002214 | 53.512629 | -1.869188 | STXE41500J3.EX | IndexOption_EURO_STXE41500J3.EX | None | 28.628812 | 10.0 | UNITS | 2023-09-27T08:00:00Z | 77.6 | 100.062169 | 100.062169 | 77.6 | User | Default | Vanilla | 75.02 | 75.02 | 1.806588 | 1190.534783 | 1190.534783 | 28.669762 | 1.868718 | BlackScholes | [BlackScholes, Binomial] | 0.0 | 0.0 | 13.314312 | 13.314312 | 1.331431 | 3.977 | -124.986257 | -124.986257 | -12.498626 | -1.618946e-06 | -1.618946e-06 | 4150.0 | -17.855180 | -17.855180 | -1.785518 | 75.02 | 75.02 | 0.000785 | 1.806588 | 776.0 | 776.0 | 776.0 | 776.0 | -187.151273 | -187.151273 | EUR | 4152.58 | User | .STOXX50E | Default | 2023-09-27T08:00:00Z | -0.102687 | -0.102687 | 41.116616 | 41.116616 | 4.111662 | 17.345784 | 17.345784 | Calculated | 9.356929 | 9.356929 | 0.063014 | -0.012711 | -0.012711 |

response6df = Fin_Contracts_Chunk_Calls_Content_Lay(

req_univ=[ # C here is for the fact that we're using the content layer

option.Definition(

underlying_type=option.UnderlyingType.ETI,

buy_sell='Buy',

instrument_code=instrument,

strike=float(strikePrice),

pricing_parameters=option.PricingParameters(

valuation_date=str(

ATdf_th.index[i][0]).replace(" ", "T").split("+", 1)[0] + "Z",

market_value_in_deal_ccy=float(ATdf_th.iloc[:,0][i]),

risk_free_rate_percent=float(ATdf_th['EurRfRate'][i]),

underlying_price=float(

ATdf_th['underlying ' + underlying + ' TRDPRC_1'][i]),

pricing_model_type='BlackScholes',

volatility_type='Implied',

underlying_time_stamp='Default',

report_ccy='EUR'))

for i in range(len(ATdf_th))],

request_fields=request_fields)

Batch of 44 requests no. 1/1 started

Batch of 44 requests no. 1/1 ended

ATIPADf = response6df.copy() # IPA here stands for the service we used to get all the calculated valuse, Instrument Pricint Analitycs.

ATIPADf.index = ATdf_th.index

ATIPADf.columns.name = ATdf_th.columns.name

ATIPADf.rename(inplace=True, columns={

"Volatility": 'ImpliedVolatility',

"MarketValueInDealCcy": f"OptnMrktValueInDealCcy-{__optn_mrkt_price_gmt.columns[0]}"})

ATIPADf.head(2)

| STXE41500J3.EX | AverageSoFar | AverageType | BarrierLevel | BarrierType | BreakEvenDeltaAmountInDealCcy | BreakEvenDeltaAmountInReportCcy | BreakEvenPriceInDealCcy | BreakEvenPriceInReportCcy | CallPut | CbbcOptionType | CbbcType | CharmAmountInDealCcy | CharmAmountInReportCcy | ColorAmountInDealCcy | ColorAmountInReportCcy | ConversionRatio | DailyVolatility | DailyVolatilityPercent | DaysToExpiry | DealCcy | DeltaAmountInDealCcy | DeltaAmountInReportCcy | DeltaExposureInDealCcy | DeltaExposureInReportCcy | DeltaHedgePositionInDealCcy | DeltaHedgePositionInReportCcy | DeltaPercent | DividendType | DividendYieldPercent | DvegaDtimeAmountInDealCcy | DvegaDtimeAmountInReportCcy | EndDate | ErrorMessage | ExerciseStyle | FixingCalendar | FixingDateArray | FixingEndDate | FixingFrequency | FixingNumbers | FixingStartDate | ForecastDividendYieldPercent | GammaAmountInDealCcy | GammaAmountInReportCcy | GammaPercent | Gearing | HedgeRatio | InstrumentCode | InstrumentDescription | InstrumentTag | Leverage | LotSize | LotsUnits | MarketDataDate | OptnMrktValueInDealCcy-TRDPRC_1 | MoneynessAmountInDealCcy | MoneynessAmountInReportCcy | OptionPrice | OptionPriceSide | OptionTimeStamp | OptionType | PremiumOverCashInDealCcy | PremiumOverCashInReportCcy | PremiumOverCashPercent | PremiumPerAnnumInDealCcy | PremiumPerAnnumInReportCcy | PremiumPerAnnumPercent | PremiumPercent | PricingModelType | PricingModelTypeList | ResidualAmountInDealCcy | ResidualAmountInReportCcy | RhoAmountInDealCcy | RhoAmountInReportCcy | RhoPercent | RiskFreeRatePercent | SevenDaysThetaAmountInDealCcy | SevenDaysThetaAmountInReportCcy | SevenDaysThetaPercent | SpeedAmountInDealCcy | SpeedAmountInReportCcy | Strike | ThetaAmountInDealCcy | ThetaAmountInReportCcy | ThetaPercent | TimeValueInDealCcy | TimeValueInReportCcy | TimeValuePerDay | TimeValuePercent | TotalMarketValueInDealCcy | TotalMarketValueInDealCcy | TotalMarketValueInReportCcy | TotalMarketValueInReportCcy | UltimaAmountInDealCcy | UltimaAmountInReportCcy | UnderlyingCcy | UnderlyingPrice | UnderlyingPriceSide | UnderlyingRIC | UnderlyingTimeStamp | ValuationDate | VannaAmountInDealCcy | VannaAmountInReportCcy | VegaAmountInDealCcy | VegaAmountInReportCcy | VegaPercent | ImpliedVolatility | VolatilityPercent | VolatilityType | VolgaAmountInDealCcy | VolgaAmountInReportCcy | YearsToExpiry | ZommaAmountInDealCcy | ZommaAmountInReportCcy |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| gmt | cet | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2023-09-21 10:40:00+00:00 | 2023-09-21 12:40:00+02:00 | <NA> | NaN | None | 0.405318 | 0.405318 | 4269.0 | 4269.0 | CALL | <NA> | -0.640398 | -0.640398 | -0.010471 | -0.010471 | 0 | 1.137092 | 1.137092 | 29 | EUR | 6.25043 | 6.25043 | -6.25043 | -6.25043 | -26321.686034 | -26321.686034 | 0.625043 | HistoricalYield | 3.36275 | -3063.740497 | -3063.740497 | 2023-10-20 | EURO | <NA> | <NA> | NaT | <NA> | 0 | NaT | <NA> | 0.017762 | 0.017762 | 0.001776 | 35.388067 | -1.59989 | STXE41500J3.EX | IndexOption_EURO_STXE41500J3.EX | <NA> | 22.119064 | 10 | UNITS | 2023-09-21 10:40:00 | 119.0 | 101.474217 | 101.474217 | 119.0 | User | Default | Vanilla | 57.82 | 57.82 | 1.373012 | 727.734483 | 727.734483 | 17.281011 | 2.825811 | BlackScholes | [BlackScholes, Binomial] | 0 | 0 | 19.661623 | 19.661623 | 1.966162 | 3.955 | -100.137886 | -100.137886 | -10.013789 | -0.000003 | -0.000003 | 4150 | -14.305412 | -14.305412 | -1.430541 | 57.82 | 57.82 | 0.000473 | 1.373012 | 1190 | 1190 | 1190 | 1190 | -3536.388733 | -3536.388733 | EUR | 4211.18 | User | .STOXX50E | Default | 2023-09-21 10:40:00 | -0.570353 | -0.570353 | 44.483776 | 44.483776 | 4.448378 | 18.050781 | 18.050781 | Calculated | 217.060823 | 217.060823 | 0.079452 | -0.008973 | |||

| 2023-09-21 11:00:00+00:00 | 2023-09-21 13:00:00+02:00 | <NA> | NaN | None | 0.408127 | 0.408127 | 4270.8 | 4270.8 | CALL | <NA> | -0.684186 | -0.684186 | -0.010336 | -0.010336 | 0 | 1.129721 | 1.129721 | 29 | EUR | 6.323656 | 6.323656 | -6.323656 | -6.323656 | -26653.579203 | -26653.579203 | 0.632366 | HistoricalYield | 3.36275 | -3080.599046 | -3080.599046 | 2023-10-20 | EURO | <NA> | <NA> | NaT | <NA> | 0 | NaT | <NA> | 0.017752 | 0.017752 | 0.001775 | 34.891556 | -1.581364 | STXE41500J3.EX | IndexOption_EURO_STXE41500J3.EX | <NA> | 22.064221 | 10 | UNITS | 2023-09-21 11:00:00 | 120.8 | 101.563855 | 101.563855 | 120.8 | User | Default | Vanilla | 55.9 | 55.9 | 1.326247 | 703.568966 | 703.568966 | 16.692424 | 2.866023 | BlackScholes | [BlackScholes, Binomial] | 0 | 0 | 19.897513 | 19.897513 | 1.989751 | 3.955 | -98.998021 | -98.998021 | -9.899802 | -0.000003 | -0.000003 | 4150 | -14.142574 | -14.142574 | -1.414257 | 55.9 | 55.9 | 0.000457 | 1.326247 | 1208 | 1208 | 1208 | 1208 | -4028.476227 | -4028.476227 | EUR | 4214.9 | User | .STOXX50E | Default | 2023-09-21 11:00:00 | -0.611776 | -0.611776 | 44.225089 | 44.225089 | 4.422509 | 17.933765 | 17.933765 | Calculated | 246.998342 | 246.998342 | 0.079452 | -0.008907 |

def Get_ooth(

df,

tz=None,

mrkt_exhng_open_time=mrkt_exhng_open_time,

mrkt_exhng_close_time=mrkt_exhng_close_time):

"""Get_ooth(df, tz=None, mrkt_exhng_open_time=mrkt_exhng_close_time, mrkt_exhng_close_time=mrkt_exhng_close_time))

df (pandas dataframe):

Must have dates as `pd.Timestamp`s in its index.

returns:

List of list of two objects: the start second of each weekend day (saturnday 1st, sunday 2nd).

"""

ooth = []

for k in range(len(df)-1):

if len(pd.bdate_range(start=df.index[k], end=df.index[k+1], freq="C", weekmask="Sat Sun")) > 0:

for saturday in [j for j in pd.bdate_range(start=df.index[k], end=df.index[k+1], freq="C", weekmask="Sat")]:

# Append with the the first second of that Saturday

ooth.append([

pd.Timestamp(

year=saturday.year,

month=saturday.month,

day=saturday.day,

tzinfo=tz),

pd.Timestamp(

year=saturday.year,

month=saturday.month,

day=saturday.day,

hour=23,

minute=59,

second=59,

tzinfo=tz)])

for sunday in [j for j in pd.bdate_range(start=df.index[k], end=df.index[k+1], freq="C", weekmask="Sun")]:

ooth.append([

pd.Timestamp(

year=sunday.year,

month=sunday.month,

day=sunday.day,

tzinfo=tz),

pd.Timestamp(

year=sunday.year,

month=sunday.month,

day=sunday.day,

hour=23,

minute=59,

second=59,

tzinfo=tz)])

else:

for weekday in [j for j in pd.bdate_range(start=df.index[k], end=df.index[k+1], freq="C", weekmask="Mon Tue Wed Thu Fri")]:

ooth.append([ # Begining of day till mrkt open.

pd.Timestamp(

year=weekday.year,

month=weekday.month,

day=weekday.day,

hour=0,

minute=0,

second=1,

tzinfo=tz),

pd.Timestamp(

year=weekday.year,

month=weekday.month,

day=weekday.day,

hour=int(mrkt_exhng_open_time.split(':')[0]),

minute=int(mrkt_exhng_open_time.split(':')[1]),

tzinfo=tz)])

ooth.append([ # Mrkt close to end of day.

pd.Timestamp(

year=weekday.year,

month=weekday.month,

day=weekday.day,

hour=int(mrkt_exhng_close_time.split(':')[0]),

minute=int(mrkt_exhng_close_time.split(':')[1]),

tzinfo=tz),

pd.Timestamp(

year=weekday.year,

month=weekday.month,

day=weekday.day,

hour=23,

minute=59,

second=59,

tzinfo=tz)])

ooth = pd.Series(ooth).drop_duplicates().tolist() # There are duplicates to remove.

return ooth[1:-1] # We do not want to see the out of trading hours before the data starts and ends on the graph.

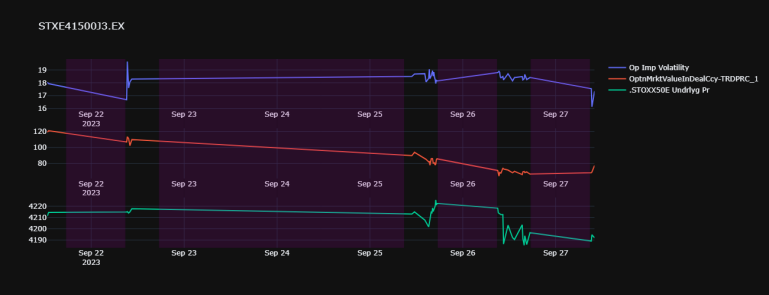

IPADfGraph = IPADf[[

'ImpliedVolatility', f"OptnMrktValueInDealCcy-{__optn_mrkt_price_gmt.columns[0]}",

'RiskFreeRatePercent', 'UnderlyingPrice', 'DeltaPercent',

'GammaPercent', 'RhoPercent', 'ThetaPercent', 'VegaPercent']].droplevel('gmt')

display(closest_atm_optn)

fig = px.line(IPADfGraph) # This is just to see the implied vol graph when that field is available