Introduction to 3D Investing

Traditional mean-variance portfolio optimization often considers only 2 investing objectives which are risk and return (2D). 3D investing, on the other hand, adds sustainability as an additional objective to optimize risk and return, as well as sustainability objectives.

adding the sustainability metric in the objective function (using a multi-objective optimization framework)

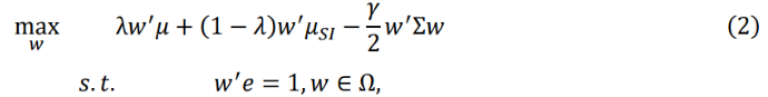

The classic mean-variance optimization problem can be written as:

where 𝑤 is an 𝑁 × 1 vector of asset weights, 𝜇 is an 𝑁 × 1 vector of expected returns, Σ is the 𝑁 × 𝑁 variance-covariance matrix, 𝑒 is an 𝑁 × 1 vector of ones, and 𝜆 and 𝛾 are scalar coefficients.

Portfolios generated under Eq. (1) are mean-variance optimal in that they achieve the maximum expected return for a given level of risk.” – 3D Investing: Jointly Optimizing Return, Risk, and Sustainability

The traditional approach of standard mean-variance optimization can readily be extended to mean variance-sustainability optimization by applying sustainability factors alongside traditional risk and return considerations.

It is straightforward to extend the mean-variance optimizer from Eq. (1) to construct portfolios on an efficient frontier surface in three (or more) dimensions. In the case of additional sustainability considerations, Eq. (1) can be extended to three dimensions as follows:

where 𝜇𝑆𝐼 is an 𝑁 × 1 vector of any (discrete or continuous) sustainability metric, 𝜆 becomes the relative preference between the return and sustainability objectives, and Ω is the set of feasible solutions, which includes any portfolio constraints.” – 3D Investing: Jointly Optimizing Return, Risk, and Sustainability

Studies suggest 3D investing can achieve better results than traditional methods, especially for portfolios with ambitious sustainability goals.

Prerequisites

- LSEG Workspace application with an access for RD library desktop session.

- Python 3.9 or above

- Python libraries

- pandas==2.1.4

- numpy==1.25.0

- refinitiv-data==1.6.0

- scipy==1.9.3

- matplotlib==3.8.0

- matplotlib-inline==0.1.6

- plotly==5.22.0

Python Code Implementation

First we're importing necessary libraries and open the data library session (some other libraries such as scipy, matplotlib, plotly will be imported in the step of visualization and analysis)

import pandas as pd

import numpy as np

import refinitiv.data as rd

rd.open_session()

# Define list of RICs for the interested instrument

rics = ['SCC.BK','PTT.BK','ADVANC.BK']

Step 1) Prepare datasets for factor modeling.

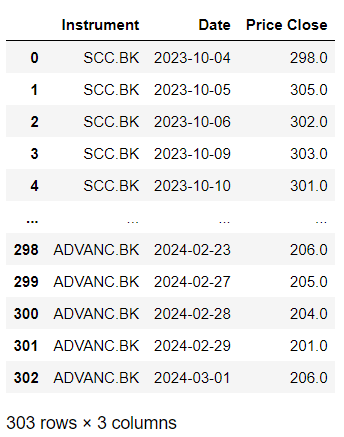

In this demonstration utilized two datasets – asset price dataset and ESG scoring dataset. The asset price dataset contains the daily closing price of the asset. The ESG score dataset contains the ESG score across multiple domains of the corresponding asset. In this demonstration, we select 3 different assets for the portfolio.

We're using a list of RICs SCC.BK, PTT.BK, ADVANC.BK here, it can be changed to the instrument you're interested or chain, such as 0#.SETI for SET Index

The RIC (Refinitiv Identification Code) is a market-level identifier for instruments and pricing sources. To find the RIC you're looking for, you can use

Price Data

# Get pricing data with get_data function

price_df = rd.get_data(rics,

['TR.PriceClose.date', 'TR.PriceClose'],

{'SDate': '2023-10-04', 'EDate': '2024-03-01', 'Frq': 'D'})

price_df['Price Close'] = price_df['Price Close'].astype(int)

price_df

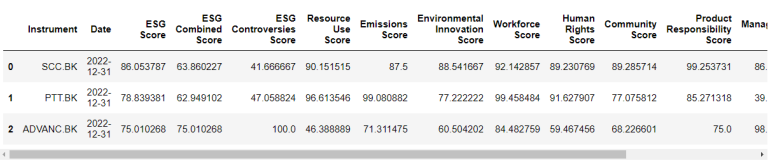

ESG Score Data

# Get ESG score data with get_data function

esg_df = rd.get_data(

universe = rics,

fields = [

'TR.TRESGScore.date',

'TR.TRESGScore',

'TR.TRESGCScore',

'TR.TRESGCControversiesScore',

'TR.TRESGResourceUseScore',

'TR.TRESGEmissionsScore',

'TR.TRESGInnovationScore',

'TR.TRESGWorkforceScore',

'TR.TRESGHumanRightsScore',

'TR.TRESGCommunityScore',

'TR.TRESGProductResponsibilityScore',

'TR.TRESGManagementScore',

'TR.TRESGShareholdersScore',

'TR.TRESGCSRStrategyScore'

]

)

esg_df

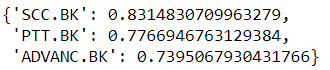

2) Calculate ESG Score of Each Asset

LSEG has developed an ESG scoring framework, aimed at providing a transparent and objective measure of a company’s ESG performance. Here we're using the ESG score on the latest date to calculate the mean ESG score of each asset.

# Calculate mean ESG score of each asset

asset_esg = {}

for i in range (3):

asset_esg[esg_df['Instrument'][i]] = esg_df.iloc[i, 2:-2].mean() * 0.01

asset_esg

Mean ESG score of each asset is as below

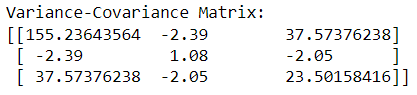

3) Calculate Variance-Covariance Matrix

Calculate variance-covariance matrix from closing price of each dataset

asset_returns = {}

for ric in rics:

# Historical returns of 3 assets over time

asset_returns[ric] = np.array(price_df[price_df['Instrument']== ric]['Price Close'])

returns_matrix = np.vstack((asset_returns['SCC.BK'], asset_returns['PTT.BK'], asset_returns['ADVANC.BK']))

# Calculate the variance-covariance matrix

covariance_matrix = np.cov(returns_matrix)

print("Variance-Covariance Matrix:")

print(covariance_matrix)

Here's the result

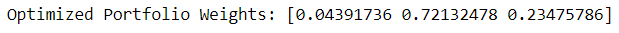

4) 3D Optimization

Initializing variables and defining objective function and sustainability constraints, the optimized portfolio weights of each asset can be calculated

from scipy.optimize import minimize

# Expected returns for 3 securities

expected_returns = np.array([0.10, 0.12, 0.11])

# Variance-covariance matrix

risk_matrix = covariance_matrix

# Sustainability scores for each security

sustainability_scores = np.array([asset_esg['SCC.BK'], asset_esg['PTT.BK'], asset_esg['ADVANC.BK']])

# Current portfolio weights

current_weights = np.array([0.2, 0.2, 0])

# Coefficient for returns

λ1 = 0.5

# Coefficient for sustainability

λ2 = 0.5

# Risk aversion coefficient

γ = 0.1

# Objective function

def objective(weights):

returns = np.dot(weights, expected_returns)

sustainability = np.dot(weights, sustainability_scores)

risk = np.dot(weights.T, np.dot(risk_matrix, weights))

turnover_penalty = np.sum((weights - current_weights)**2)

return -(λ1 * returns + λ2 * sustainability - γ/2 * risk - turnover_penalty)

# Constraints

def sustainability_constraint(weights):

return np.dot(weights, sustainability_scores) - minimum_sustainability_score

# Minimum desired sustainability score for the portfolio

minimum_sustainability_score = 0.75

cons = [{'type': 'eq', 'fun': lambda x: np.sum(x) - 1}, # Sum of weights must be 1

{'type': 'ineq', 'fun': sustainability_constraint}] # Portfolio sustainability score constraint

# Weights must be between 0 and 1

bounds = [(0, 1) for _ in range(len(expected_returns))]

# Optimization

result = minimize(objective,

current_weights,

method='SLSQP',

bounds=bounds,

constraints=cons)

# Optimized weights

optimized_weights = result.x

print("Optimized Portfolio Weights:", optimized_weights)

And the result is

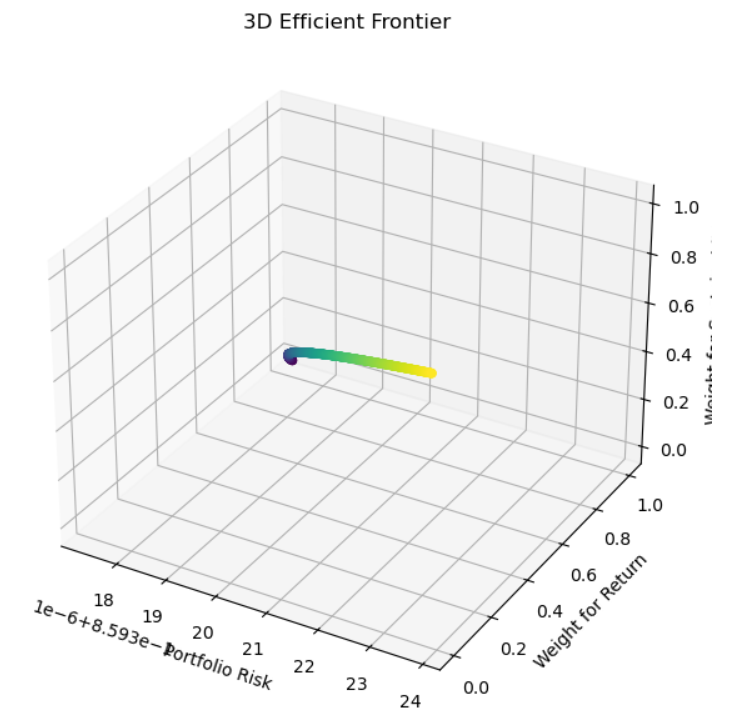

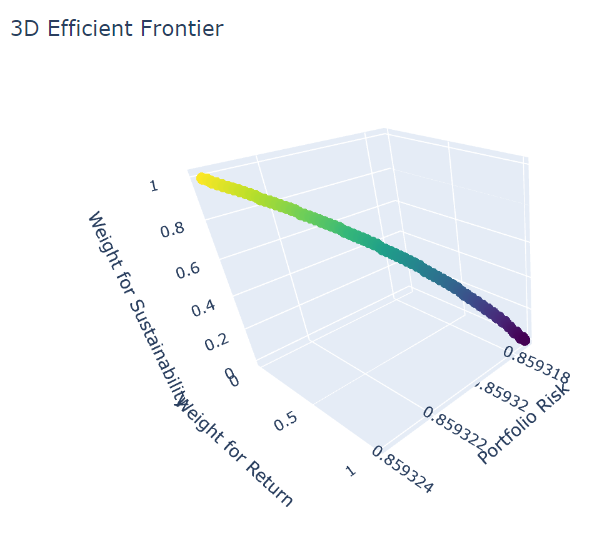

3D Efficient Frontier

Visualizes the 3D efficient frontier of a portfolio optimization considering returns, risk, and sustainability. We do two visualizations here as below

- First visualization

import matplotlib.pyplot as plt

# Number of portfolios to simulate on the efficient frontier

num_portfolios = 1000

# Store results

results = np.zeros((4, num_portfolios))

for i in range(num_portfolios):

# Adjusting the weights for the objectives (return, risk, sustainability)

λ1 = i / (num_portfolios - 1) # Weight for return

λ2 = 1 - λ1 # Weight for sustainability

# Objective function for optimization

def objective(weights):

returns = np.dot(weights, expected_returns)

risk = np.dot(weights.T, np.dot(risk_matrix, weights))

sustainability = np.dot(weights, sustainability_scores)

return -(λ1 * returns + λ2 * sustainability - risk)

# Constraints

def sustainability_constraint(weights):

return np.dot(weights, sustainability_scores) - minimum_sustainability_score

minimum_sustainability_score = 0.75 # Minimum desired sustainability score for the portfolio

cons = [{'type': 'eq', 'fun': lambda x: np.sum(x) - 1}, # Sum of weights must be 1

{'type': 'ineq', 'fun': sustainability_constraint}] # Portfolio sustainability score constraint

bounds = [(0, 1) for _ in range(len(expected_returns))] # Weights must be between 0 and 1

# Perform optimization

initial_guess = np.array([1 / len(expected_returns)] * len(expected_returns))

result = minimize(objective, initial_guess, method='SLSQP', bounds=bounds, constraints=cons)

# Store results

results[0, i] = λ1 # Weight for return

results[1, i] = λ2 # Weight for sustainability

results[2, i] = -result.fun # Portfolio objective value

results[3, i] = np.sqrt(np.dot(result.x.T, np.dot(risk_matrix, result.x))) # Portfolio risk (standard deviation)

# Plotting the 3D efficient frontier

fig = plt.figure(figsize=(10, 7))

ax = fig.add_subplot(111, projection='3d')

ax.scatter(results[3, :], results[0, :], results[1, :], c=results[1, :], cmap='viridis')

ax.set_xlabel('Portfolio Risk')

ax.set_ylabel('Weight for Return')

ax.set_zlabel('Weight for Sustainability')

ax.set_title('3D Efficient Frontier')

plt.show()

- Second visualization

import plotly.graph_objects as go

# Creating a Plotly figure

fig = go.Figure(data=[go.Scatter3d(

x=results[3, :],

y=results[0, :],

z=results[1, :],

mode='markers',

marker=dict(

size=5,

color=results[2, :], # set color to objective value

colorscale='Viridis', # choose a colorscale

opacity=0.8

)

)])

# Adding labels and title

fig.update_layout(

scene=dict(

xaxis_title='Portfolio Risk',

yaxis_title='Weight for Return',

zaxis_title='Weight for Sustainability'

),

title='3D Efficient Frontier'

)

# Show the plot

fig.show()

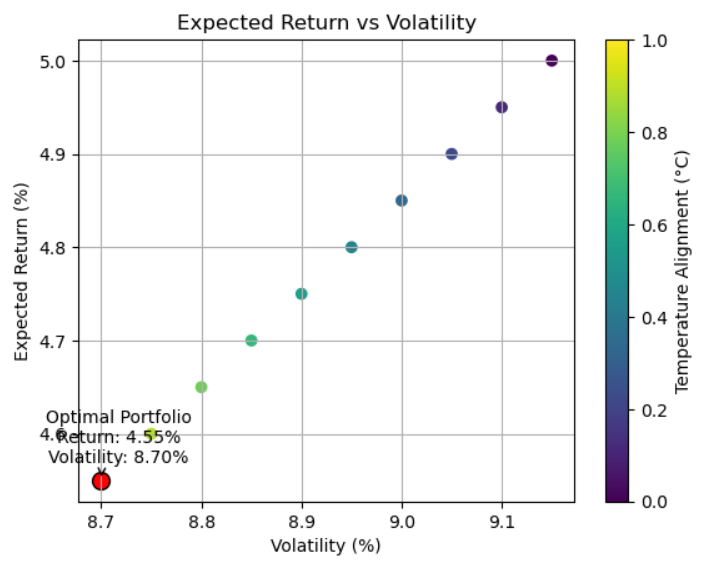

Lastly, let's plot the graph to see the relation between Expected Return and Volatility

import matplotlib.pyplot as plt

# Assuming the following data structure

# Portfolios data: Each portfolio has expected return, volatility, and temperature alignment

portfolios_data = np.array([

[4.30, 8.45, 2.6], [4.35, 8.50, 2.55], [4.40, 8.55, 2.50],

[4.45, 8.60, 2.45], [4.50, 8.65, 2.40], [4.55, 8.70, 2.35],

[4.60, 8.75, 2.30], [4.65, 8.80, 2.25], [4.70, 8.85, 2.20],

[4.75, 8.90, 2.15], [4.80, 8.95, 2.10], [4.85, 9.00, 2.05],

[4.90, 9.05, 2.00], [4.95, 9.10, 1.95], [5.00, 9.15, 1.90]

])

# Filter portfolios by a temperature target, e.g., 2.35°C

temperature_target = 2.35

portfolios = portfolios_data[portfolios_data[:, 2] <= temperature_target]

# Risk aversion scenarios (low, medium, high)

risk_aversions = ['low', 'medium', 'high']

risk_aversion_weights = {

'low': 0.1,

'medium': 0.5,

'high': 0.9

}

# Select medium risk aversion

selected_risk_aversion = 'medium'

# Calculate the optimal portfolio based on the selected risk aversion

# The optimal portfolio minimizes volatility given the expected return

weights = risk_aversion_weights[selected_risk_aversion]

optimal_portfolio = min(portfolios, key=lambda x: weights * x[1] - (1 - weights) * x[0])

# Create scatter plot for expected return vs volatility

plt.scatter(portfolios[:, 1], portfolios[:, 0], c=portfolios[:, 2], cmap='viridis')

# Highlight the optimal portfolio

plt.scatter(optimal_portfolio[1], optimal_portfolio[0], color='red', edgecolors='black', s=100)

# Annotate the optimal portfolio

plt.annotate(

f"Optimal Portfolio\nReturn: {optimal_portfolio[0]:.2f}%\nVolatility: {optimal_portfolio[1]:.2f}%",

(optimal_portfolio[1], optimal_portfolio[0]),

textcoords="offset points",

xytext=(10,10),

ha='center',

arrowprops=dict(arrowstyle="->", connectionstyle="arc3,rad=.2")

)

# Set chart title and labels

plt.colorbar(label='Temperature Alignment (°C)')

plt.title('Expected Return vs Volatility')

plt.xlabel('Volatility (%)')

plt.ylabel('Expected Return (%)')

plt.grid(True)

# Show the plot

plt.show()

Conclusion

The 3D framework is a valuable tool for investors seeking to integrate sustainability into their portfolio construction while maintaining financial objectives. By utilizing the 3D investing framework, investors can construct portfolios that meet specific sustainability targets (e.g., carbon footprint reduction) without sacrificing returns or incurring excessive costs.

- Register or Log in to applaud this article

- Let the author know how much this article helped you