World-Check Verify

The accelerating pace of the digital financial ecosystem and evolving AML/KYC regulations are reshaping compliance expectations. This means you need to screen your customers for risk – accurately and at speed.

You need a reliable solution that can help you identify potential red flags quickly and meet regulatory demands like the EU Instant payments regulation – all while reducing friction and protecting the customer experience. That’s exactly what our World-Check Verify delivers.

Fight Financial Crime with a Next-Generation Screening Solution

World-Check Verify is LSEG's next-generation, cloud-native screening API, purpose-built for the fast-paced world of modern payments. Delivered as a REST/JSON web service exclusively over HTTPS, it enables stateless, real-time, low-latency screening of individuals and entities against both World-Check risk intelligence data and client proprietary lists including global sanctions, law & regulatory enforcement lists, PEPs, and adverse media. Crucially, the service does not store any customer screening data, ensuring privacy and compliance.

Designed for seamless integration into existing AML/KYC workflows, World-Check Verify supports name screening for both traditional use cases like Customer Onboarding, KYC, Third-Party Due Diligence, and Transaction screening, as well as modern financial use cases such as Digital Onboarding and Payment screening.

Leverage our advanced policy builder app to configure screening rules tailored to your organisation’s risk appetite and compliance needs. The matching engine, which helped LSEG customers to screen over 4.7 billion names so far, uses a multi-layered approach with flexible auto-resolution capabilities to significantly reduce false positives.

The API schema is in Swagger 2.0 format (also known as the OpenAPI specification format), enabling developers to benefit from many supporting tools, documentation and resources available within the Swagger/OpenAPI ecosystem.

Key features

Real-Time Screening

Instantly screen individuals or entities during onboarding or transactions with ultra-fast response times and near real-time data updates.Stateless API

No customer data is stored, enabling seamless integration while ensuring privacy, security, and simplified compliance with data protection regulations.Advanced Name Matching

Combines rules-based logic and machine learning algorithms for high accuracy and significantly reduced false positives.Global Risk Intelligence

Screens against client proprietary lists and LSEG’s trusted World-Check data, including sanctions, law & regulatory enforcement lists, PEPs, and adverse media.High Scalability

Cloud-native architecture to support horizontal scalability and high volume, high throughput workflows.High Availability

Engineered for very high-availability to support mission-critical compliance workflows in modern payment ecosystems.Data Privacy

Supports in-region data hosting through AWS, enabling deployments in key markets and ensuring data sovereignty..Secure Integration

REST/JSON API accessible exclusively over HTTPs using OAuth 2.0, easily embedded into existing KYC, AML, or payment workflows for name screening purposes.

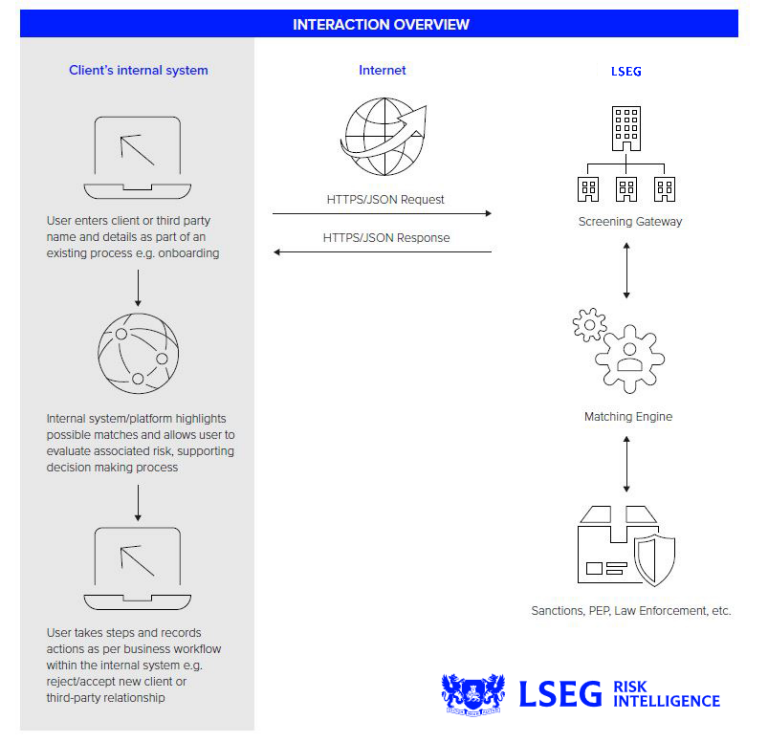

Below is a diagram illustrating a high-level sample interaction between your internal system and the World-Check Verify API.

Get Started

World-Check Verify is a commercial offering and requires product licensing to access. If you already have access, your credentials can be used for token-based authentication to start integrating with the API. If you do not have access, please contact your LSEG Account Manager or request a freet trial.

As a developer, you have full access to our comprehensive developer portal resources, including technical documentation and user guides. If you have been provisioned with a Pilot account, you can build and test your integration in a safe environment before moving to production.

To check your access and get started, please head over to our Quick Start guide.

About Us

LSEG Risk Intelligence - Opening a world of possibilities by protecting you from a world of risks!

An increasingly digital economy and volatile geopolitical backdrop are generating new threats and opportunities for organisations to address.

You can confidently do business with your customers and suppliers while reducing time to revenue for new clients. With our comprehensive suite of solutions, you can remove barriers and operational costs associated with vendor management, and create superior customer experiences that set you apart from your competition.

Want to explore more about LSEG Risk Intelligence and our solutions? Head over to our website.

Want to contact your local office? Check out LSEG locations.

SUBSCRIBE TO THIS API UPDATES

Discover

Useful Links

Request Free Trial

Call your local sales team

Americas

All countries (toll free): +1 800 427 7570

Brazil: +55 11 47009629

Argentina: +54 11 53546700

Chile: +56 2 24838932

Mexico: +52 55 80005740

Colombia: +57 1 4419404

Europe, Middle East, Africa

Europe: +442045302020

Africa: +27 11 775 3188

Middle East & North Africa: 800035704182

Asia Pacific (Sub-Regional)

Australia & Pacific Islands: +612 8066 2494

China mainland: +86 10 6627 1095

Hong Kong & Macau: +852 3077 5499

India, Bangladesh, Nepal, Maldives & Sri Lanka:

+91 22 6180 7525

Indonesia: +622150960350

Japan: +813 6743 6515

Korea: +822 3478 4303

Malaysia & Brunei: +603 7 724 0502

New Zealand: +64 9913 6203

Philippines: 180 089 094 050 (Globe) or

180 014 410 639 (PLDT)

Singapore and all non-listed ASEAN Countries:

+65 6415 5484

Taiwan: +886 2 7734 4677

Thailand & Laos: +662 844 9576