(Deprecated) LSEG Robust Foundation API (RFA) - .NET

We have something better… At the moment this API is still fully supported however, it is being reviewed for end-of-life in the near future. In the meantime we have a new API that should suit your needs better.

The LSEG Robust Foundation API (RFA) .NET Edition is available for download in the Downloads tab. RFA 8.X has support for RSSL protocol.

IMPORTANT Rebranding Annoucement: Starting with version RFA .NET 8.2, there are namespace changes in libraries. Please note that all interfaces remain the the same as prior releases of RFA and will remain fully wire compatible. Along with RFA packages and in the same location as release notes, a REBRAND text file is available which details impact to existing applications, if ANY, and how to quickly adapt to the re-branded libraries. Existing applications will continue to work indefinetly as-is. Applications should be proactively rebranded to be able to pick up fixes or support for new compilers and operating systems, available post rebranding release. For more details on support, refer to PCN .

API Description

The LSEG Robust Foundation API (RFA) .NET Edition provides data-neutral, thread-aware access for consuming and providing market information and some generic configuration and logging capabilities using the .NET programming language. It is a developer toolkit that gives customer applications access to a wide range of financial data from LSEG Real-Time Platform, 3rd party, and in-house sources. The RFA .NET Edition is a highly performing API and offers low latency, high throughput data delivery solutions.

With the RFA .NET Edition, developers have the ability to extend their use of RFA even further into the enterprise by using the Open Message Model (OMM) interfaces. The OMM provides an extremely flexible set of messaging constructs that allow complex data types to be expressed, cached, and delivered through the Real-Time Distribution System (RTDS). We used OMM to normalize all exchange data in Real-Time Platform with full order book support.

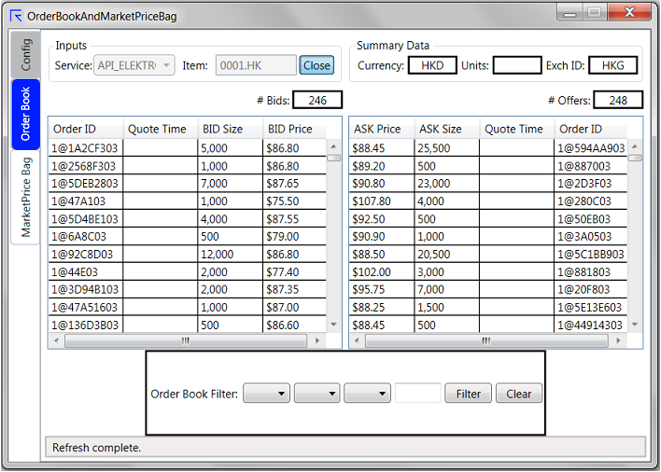

OMM opens up RTDS to an unlimited range of structured data models such as Order Books, Market Makers, Symbol Lists, and Dictionaries in addition to existing field/value-oriented data. Customers, partners, and 3rd parties can use OMM to create new data models for a wide variety of data types with a range of interaction types from static reference data to the high-updating, low-latency market data. Once encoded using OMM structures, this data can be distributed through RTDS using a high-performance binary wire format while leveraging the existing capabilities of the RTDS.

The screenshot above shows an example program, included with RFA .NET, displaying real-time full order book data.

RFA .NET supports multi-threaded programming. It also includes a generic set of logging and configuration interfaces that applications can use to log application-specific messages and perform their own configuration.

RFA .NET supports connectivity to the Real-Time Platform, a low-latency consolidated global data feed that delivers full tick, depth-of-market data, and the RTDS, through the Domain Models (RDM).

RFA .NET is composed of several packages. Each API package included in RFA comprises all the necessary components, including libraries, full documentation, and examples of how the API is used.

The addition of Value Added Components has been integrated into the RFA package. The Value Added Components provide a set of classes that virtually eliminate routine initialization of RFA and handles all encoding and decoding of the specific RDM domains.

Request Free Trial

Call your local sales team

Americas

All countries (toll free): +1 800 427 7570

Brazil: +55 11 47009629

Argentina: +54 11 53546700

Chile: +56 2 24838932

Mexico: +52 55 80005740

Colombia: +57 1 4419404

Europe, Middle East, Africa

Europe: +442045302020

Africa: +27 11 775 3188

Middle East & North Africa: 800035704182

Asia Pacific (Sub-Regional)

Australia & Pacific Islands: +612 8066 2494

China mainland: +86 10 6627 1095

Hong Kong & Macau: +852 3077 5499

India, Bangladesh, Nepal, Maldives & Sri Lanka:

+91 22 6180 7525

Indonesia: +622150960350

Japan: +813 6743 6515

Korea: +822 3478 4303

Malaysia & Brunei: +603 7 724 0502

New Zealand: +64 9913 6203

Philippines: 180 089 094 050 (Globe) or

180 014 410 639 (PLDT)

Singapore and all non-listed ASEAN Countries:

+65 6415 5484

Taiwan: +886 2 7734 4677

Thailand & Laos: +662 844 9576