FX Global Credit Management API (REST)

NOTE: LSEG has reviewed our ongoing technology programmes and determined that we will deliver better outcomes for you by making some modifications to our approach. This is so we can best meet your needs in the coming years.

Changes will be made to our APIs and associated documentation over the next few months reflecting the programme changes communicated on 2 December 2024. For any clarifications please email FXTAM@lseg.com.

Introduction

The FX Global Credit Management (FXGCM) is the new global credit service offered by our FX venues for its market participants to manage their bilateral and sponsorship credit risks. It will allow participants to manage credit across all FX instruments covering NDF, Spot, Forward, Swaps which are executed across all trading paradigms CLOB, Secondary ECN, RFS and RFQ. Participants are able to access a substantial scope of FXGCM functionality via an API.

FXGCM Credit Models

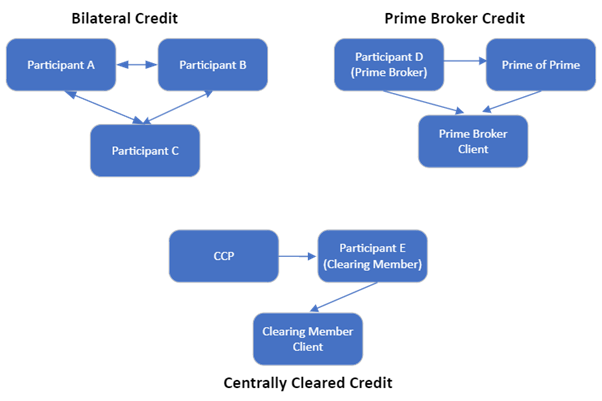

FXGCM provides global credit management via three main credit models:

- Bilateral Credit

- Prime Broker Credit

- Centrally Cleared Credit

Bilateral and prime broker credit models will be supported with Net and Gross Daily Trading Limit (DTL), Net and Gross Daily Settlement Limit (DSL) and Net Open Position (NOP) measures. Centrally cleared credit is based on an initial margin limit which reflects the trade level initial margin charged by the relevant Derivatives Clearing Organisation (DCO) or a central counter party (CCP).

FXGCM Credit Functionality

Each market participant is modelled via a standard top-down structure of Ultimate Parent Company (UPC), Settlement Entity (SE) and Credit Code. A Credit Code will be identical to Trading Code used in trading space. Credit codes can be further grouped in to create participant defined groups such as organisational credit groups (OCG), counterparty credit groups (CCG), and prime broker client groups (PoP groups inclusive) to simplify credit assignment. FXGCM users can create and update credit lines between such entity structures as per the credit model of their interest.

Trading Controls such as kill switches and order limits are supported through FXGCM to ensure trading is managed within the clients’ overall risk appetite. Order parameters such as maximum order size (MOS) and maximum open orders per instrument (MOOPI) can be set through the credit API, which will immediately be applicable at order entry of each trading venue.

FXGCM Credit API

The API will be on a JSON (JavaScript Object Notation) based Representation State Transfer (REST) protocol that provides URLs representing the HTTP methods as GET request to retrieve data, PUT request to amend data, POST request to create new data and DELETE request to delete data. The REST API will use standard AAA (Authentication Authorisation and Accounting framework) based authentication. The API will honour the standard (HTTP) response status codes. For example, a successful REST request will be responded as a http 200 OK response. Any unauthorized action by an API user will result in a http 403 Forbidden response. Any validation failures will return a 400 Bad Request response with the validation failure error message and a business error code (2000xxxx) included in the body.

Each API request will be authenticated independently. As such, all API requests are expected to carry a bearer token obtained from an LSEG identity provider service (PING Identity) for FXGCM to validate it against the registered credit users. 3rd party integrators acting on behalf of participants will use security credentials of the participants.

All successful responses from the FXGCM REST API will include an Internal Identifier that can be used for auditability purposes and to investigate the state of the system at the time.

FXGCM REST API will not provide backward compatibility for the existing heritage LSEG FXall and LSEG Matching Credit APIs.

Updates

2 December 2024

- Communication to all clients about changes to the programme. Note added to top of page.

7 August 2024

19 June 2024

- Global Credit Management API (REST) Interface Specification

25 March 2024

4 December 2023

22 November 2023

13 November 2023

10 November 2023

1 November 2023

31 October 2023

24 October 2023

- Testing Services Guide

- FX Global Credit Management API Conformance Test Plan

- FX Global Credit Management API Test Report

16 October 2023

7 Sep 2023

12 June 2023

23 May 2023

17 May 2023