FX Credit - NDF Matching API

Introduction

The FX Credit Management - NDF Matching API provides programmatic access to LSEG FX Credit Management services for its market participants to manage their bilateral and sponsorship credit risks. It will allow participants to manage credit across all FX instruments covering NDF, Spot, Forward, Swaps which are executed across all trading paradigms CLOB, Secondary ECN, RFS and RFQ.

LSEG FX Credit Models

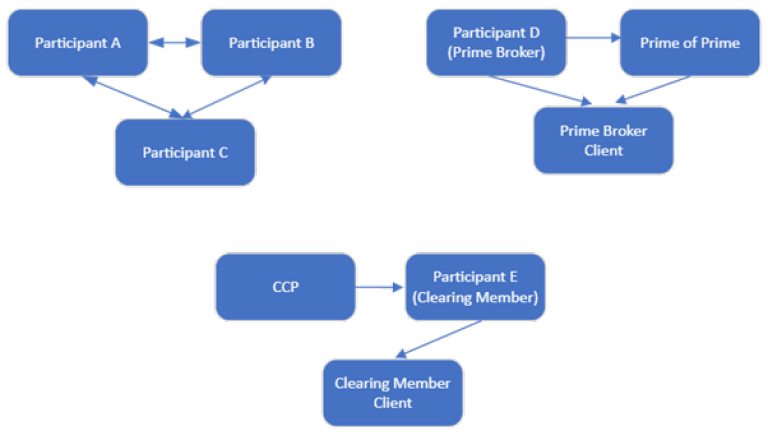

LSEG FX provides credit management via three main credit models:

- Bilateral Credit

- Prime Broker Credit

- Centrally Cleared Credit

Bilateral and prime broker credit models will be supported with Net and Gross Daily Trading Limit (DTL), Net and Gross Daily Settlement Limit (DSL) and Net Open Position (NOP) measures. Centrally cleared credit is based on an initial margin limit which reflects the trade level initial margin charged by the relevant Derivatives Clearing Organisation (DCO) or a central counter party (CCP).

LSEG FX Credit Functionality

Each market participant is provided a number of credit codes appropriate for their use case. A Credit Code will be identical to Trading Code used in trading space. Credit codes can be further grouped in to create participant defined groups such as organisational credit groups (OCG), counterparty credit groups (CCG), and prime broker client groups (PoP groups inclusive) to simplify credit assignment. Credit Management users can create and update credit lines between such entity structures as per the credit model of their interest.

Trading Controls such as kill switches and order limits are supported to ensure trading is managed within the clients’ overall risk appetite. Order parameters such as maximum order size (MOS) and maximum open orders per instrument (MOOPI) can be set through the Credit API, which will immediately be applicable at order entry of each trading venue.

FX Credit Management API - NDF Matching

The API will be on a JSON (JavaScript Object Notation) based Representation State Transfer (REST) protocol that provides URLs representing the HTTP methods as GET request to retrieve data, PUT request to amend data, POST request to create new data and DELETE request to delete data. The REST API will use standard AAA (Authentication Authorisation and Accounting framework) based authentication. The API will honour the standard (HTTP) response status codes. For example, a successful REST request will be responded as a http 200 OK response. Any unauthorized action by an API user will result in a http 403 Forbidden response. Any validation failures will return a 400 Bad Request response with the validation failure error message and a business error code (2000xxxx) included in the body.

Each API request will be authenticated independently. As such, all API requests are expected to carry a bearer token obtained from an LSEG identity provider service (PING Identity) for the Credit Management service to validate it against the registered credit users. 3rd party integrators acting on behalf of participants will use security credentials of the participants.

All successful responses from the REST API will include an Internal Identifier that can be used for auditability purposes and to investigate the state of the system at the time.

Updates

3 September 2025

1 September 2025

27 May 2025

23 May 2025

27 March 2025

11 February 2025

The following documents have been updated alongside the new NDF Matching functional release into CDS to reflect NDF Matching only functionality.

- NDF Matching Credit Management API Specification

- NDF Matching Testing Services Guide

- NDF Matching Credit Management API Conformance Test Plan

- NDF Matching Credit Management API Conformance Test Report

31 January 2025

- NDF Matching Credit Release Notes

- FXGCM User Guide

2 December 2024

- Communication to all clients about changes to the programme. Note added to top of page.

7 August 2024

19 June 2024

- Global Credit Management API (REST) Interface Specification

25 March 2024

4 December 2023

22 November 2023

13 November 2023

10 November 2023

1 November 2023

31 October 2023

24 October 2023

- Testing Services Guide

- FX Global Credit Management API Conformance Test Plan

- FX Global Credit Management API Test Report

16 October 2023

7 Sep 2023

12 June 2023

23 May 2023

17 May 2023

SUBSCRIBE TO THIS API UPDATES

Related APIs

Request Free Trial

Call your local sales team

Americas

All countries (toll free): +1 800 427 7570

Brazil: +55 11 47009629

Argentina: +54 11 53546700

Chile: +56 2 24838932

Mexico: +52 55 80005740

Colombia: +57 1 4419404

Europe, Middle East, Africa

Europe: +442045302020

Africa: +27 11 775 3188

Middle East & North Africa: 800035704182

Asia Pacific (Sub-Regional)

Australia & Pacific Islands: +612 8066 2494

China mainland: +86 10 6627 1095

Hong Kong & Macau: +852 3077 5499

India, Bangladesh, Nepal, Maldives & Sri Lanka:

+91 22 6180 7525

Indonesia: +622150960350

Japan: +813 6743 6515

Korea: +822 3478 4303

Malaysia & Brunei: +603 7 724 0502

New Zealand: +64 9913 6203

Philippines: 180 089 094 050 (Globe) or

180 014 410 639 (PLDT)

Singapore and all non-listed ASEAN Countries:

+65 6415 5484

Taiwan: +886 2 7734 4677

Thailand & Laos: +662 844 9576